- Solutions

- Resources

- About

- Consumer Research

- Media Consumption & Trends

- Understanding Consumers

Drive Away from the Competition through Actionable Consumer Insights

To uncover what the modern car customer looks like, we looked at the data. We used cutting-edge market research and consumer insights solution InMobi Pulse to look at some of the biggest car research properties in the U.S., along with data on how people use the mobile apps of the major automakers themselves.

We first looked at the common traits of those in the U.S. who already are customers of the world’s biggest car brands. This data was uncovered by looking at those who have apps indicating ownership from these automakers on their mobile devices. We then compared those insights to the mobile audience data from major car buying and car research websites, to discover the overlap between those who have an affinity for a particular brand and those currently in the car buying research process.

The profiles of car owners of auto brands are derived from data around deterministic auto owner properties such as car finance apps. The auto brands reviewed include Chevrolet, Chrysler, Ford, Honda, Hyundai, Kia, Nissan, Subaru, Tesla, Toyota and Volkswagen.

Car Owner Highlights:

- Car owners (i.e. those that have downloaded car brand apps that indicate car ownership) across brands tend to be highest in the 46-55 age group.

- Individuals with auto finance apps tend to be younger, single renters (i.e. not homeowners). They’re also more likely than other car owners to have other finance-related apps on their mobile devices.

- Audio Buffs, Social Media Enthusiasts and Online Shoppers are the three most prominent Car User segments across car brands.

- Nissan, Subaru, Toyota, Honda and Hyundai are the only brands with websites that have audiences that are close to or over half female.

- A notable percentage of Hyundai owners are 66 and older.

- Only finance apps have more than 20% of their audience between the ages of 26 and 35, and every app has less than 10% of its audience between 18 and 25.

- Ford, Tesla, Volkswagen and Subaru owners have a higher tendency to be homeowners.

- Ford and Tesla performs better than other auto brands with individuals having Bachelor’s or graduate degrees, with Nissan, Subaru, Honda and Hyundai not far behind.

- Navigation apps such as Waze, Scout GPS link, Telenav and Google Street View show up often and for longer session lengths across web and app properties in Subaru, Tesla, Kia and Toyota owners.

- The digital persona of users who are on Auto Finance apps is very different from non-Finance users; they tend to have more finance-related apps such as banking apps and other financial mobile apps such as Citi Mobile, Venmo, Wells Fargo, PayPal, Credit Karma and more.

- Electric vehicle owners tend to skew male, as the majority of those with the Tesla app and Nissan’s EV app on their mobile devices are male.

Overview of Today’s Car Owner by Brand

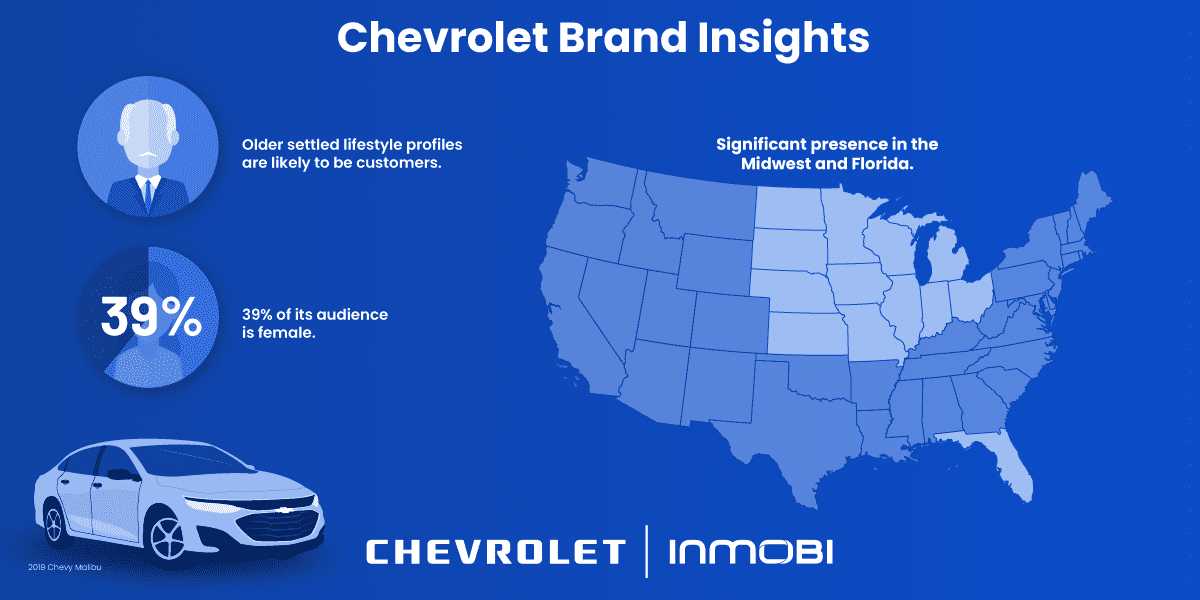

Key Chevrolet Insights:

- Significant presence in the Midwest and Florida.

- 39% of its audience is female.

- Older settled lifestyle profiles are likely to be customers.

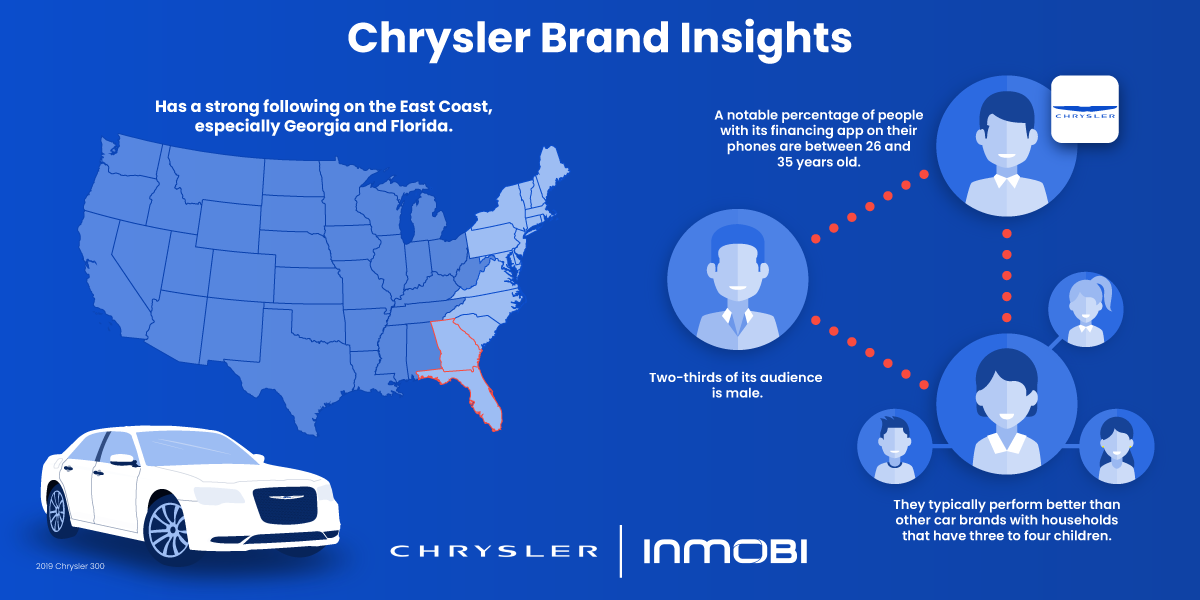

Key Chrysler Insights:

- Has a strong following on the East Coast, especially Georgia and Florida.

- Two-thirds of its audience is male.

- A notable percentage of people with its financing app on their mobile devices are between 26 and 35 years old.

- They typically perform better than other car brands with households that have three to four children.

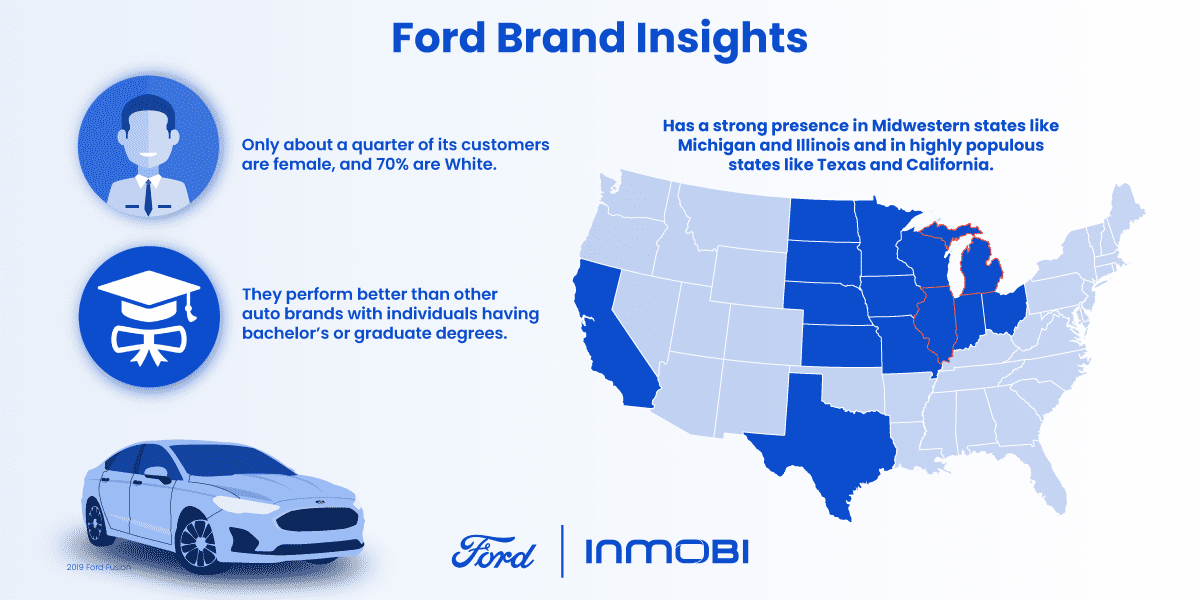

Key Ford Insights:

- Has a strong presence in Midwestern states like Michigan and Illinois, and in highly populous states like Texas and California.

- Only about a quarter of its customers are female, and 70% are White.

- They perform better than other auto brands with individuals having Bachelor’s or graduate degrees.

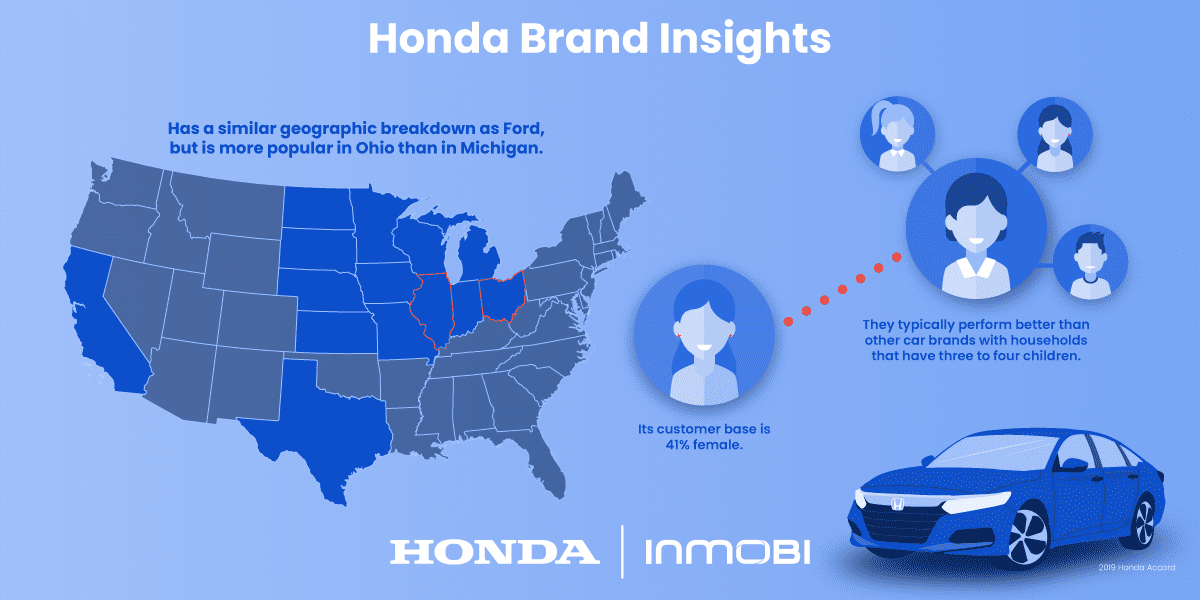

Key Honda Insights:

- Has a similar geographic breakdown as Ford, but is more popular in Ohio than in Michigan.

- Its customer base is 41% female.

- They typically perform better than other car brands with households that have three to four children.

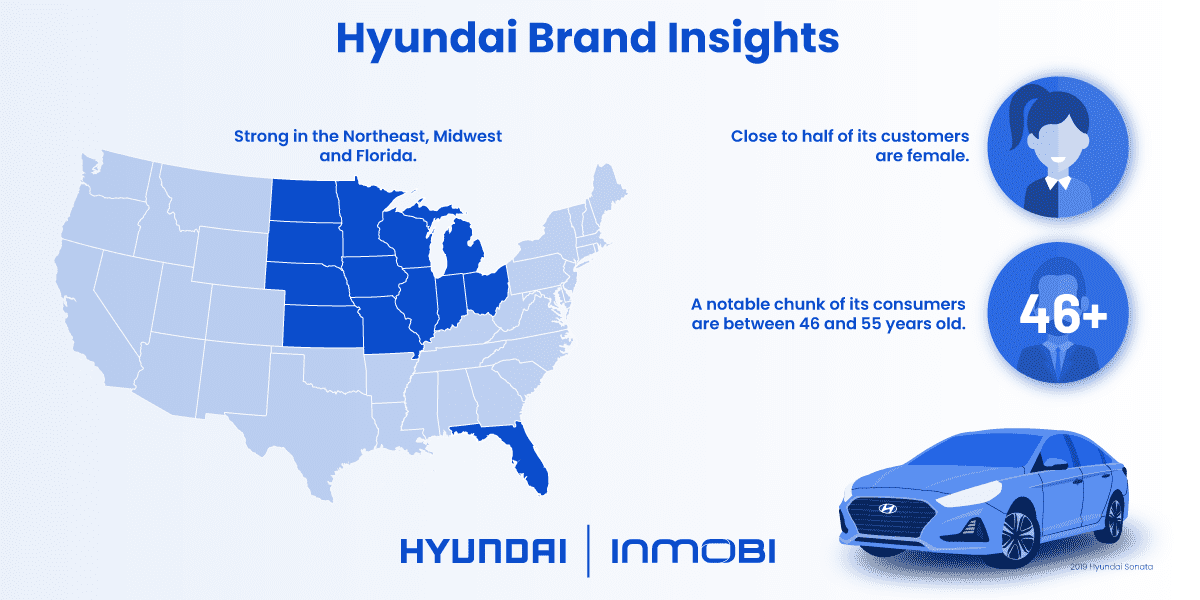

Key Hyundai Insights:

- Strong in the Northeast, Midwest and Florida.

- Close to half of its customers are female.

- A notable chunk of its consumers are between 46 and 55 years old.

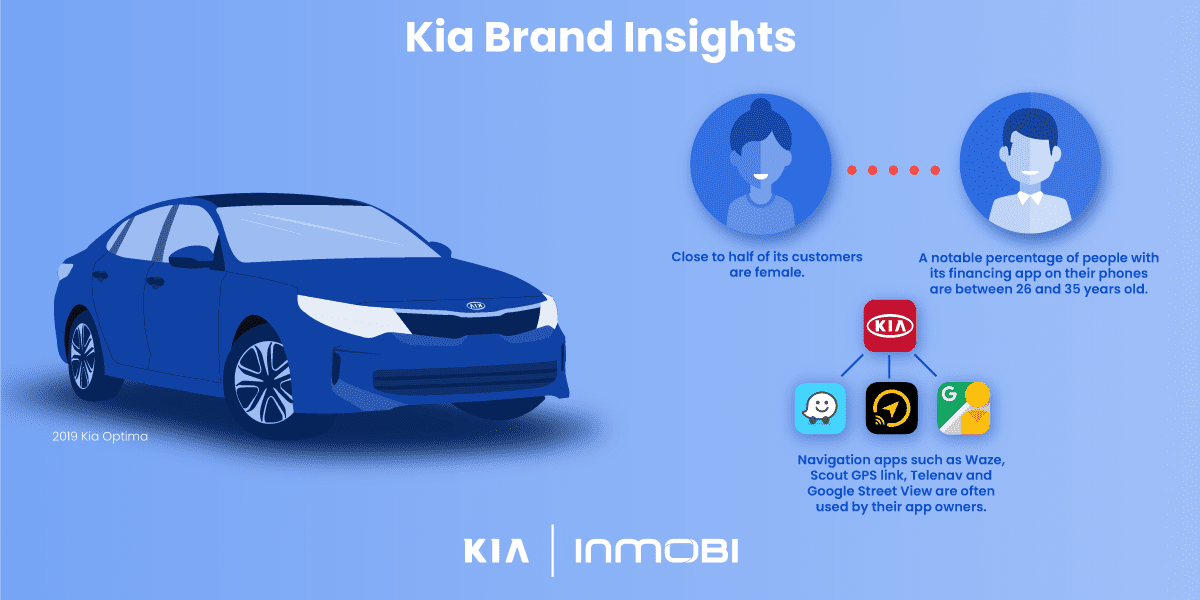

Key Kia Insights:

- A notable percentage of people with its financing app on their mobile devices are between 26 and 35 years old.

- Close to half of its customers are female.

- Navigation apps such as Waze, Scout GPS link, Telenav and Google Street View are often used with by their app owners.

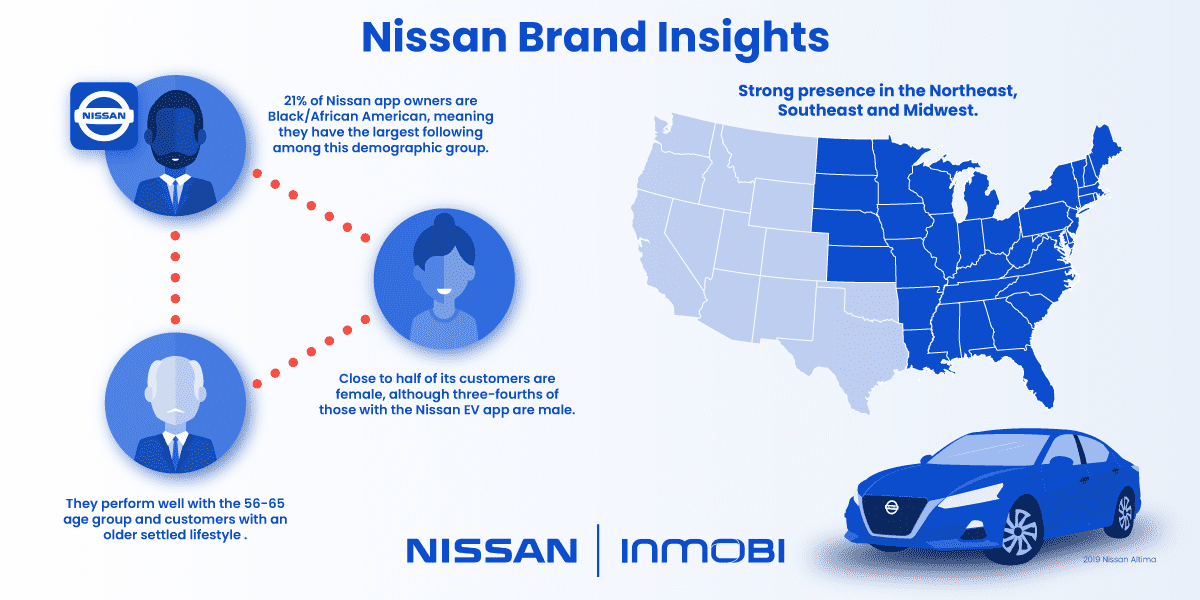

Key Nissan Insights:

- Strong presence in the Northeast, Southeast and Midwest.

- Close to half of its customers are female, although three-fourths of those with the Nissan EV app are male.

- 21% of Nissan app owners are Black/African-American, meaning they have the largest following among this demographic group.

- They perform well with the 56-65 age group.

- Older settled lifestyle profiles are likely to be customers.

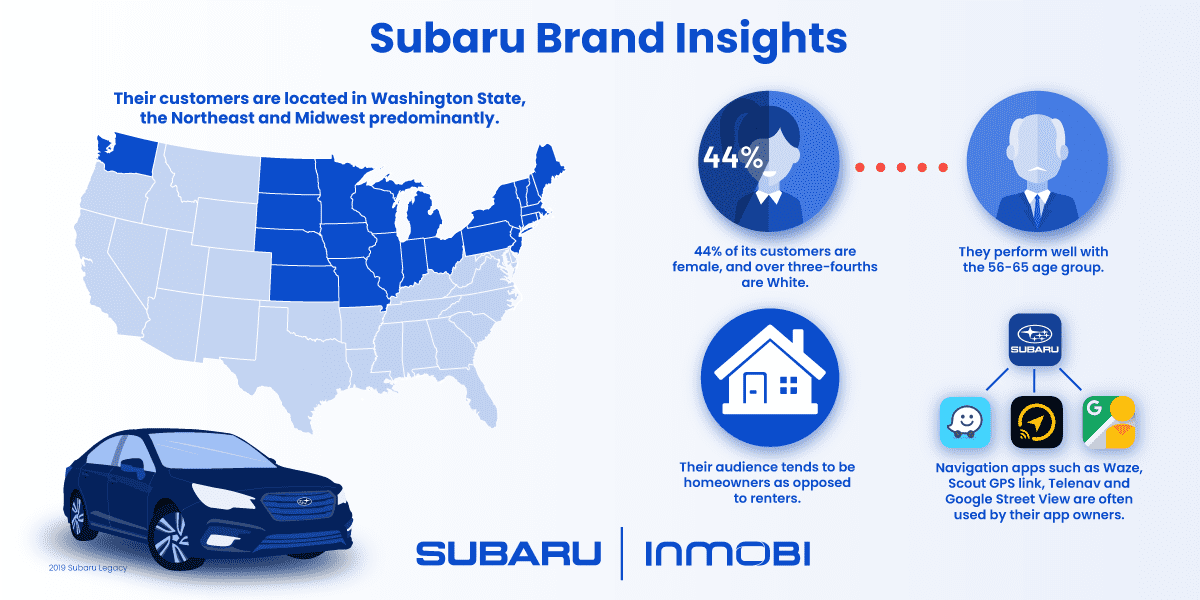

Key Subaru Insights:

- 44% of its customers are female, and over three-fourths are White.

- Their customers are located in Washington State, the Northeast and Midwest predominantly.

- They perform well with the 56-65 age group.

- Their audience tends to be homeowners as opposed to renters.

- Navigation apps such as Waze, Scout GPS link, Telenav and Google Street View are often used with by their app owners.

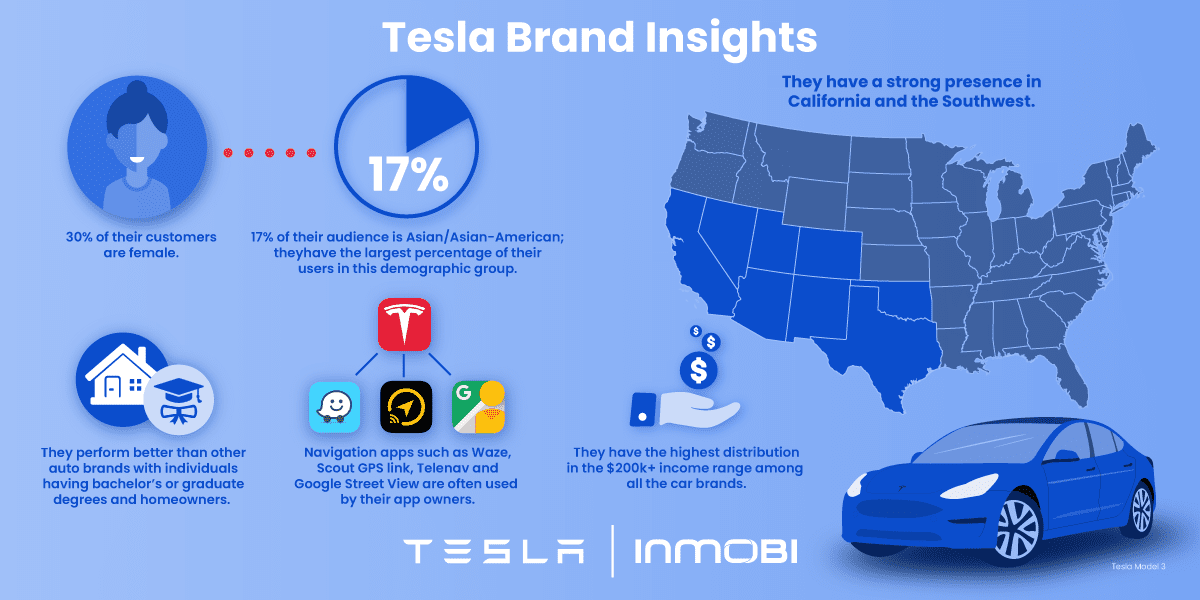

Key Tesla Insights:

- They have the highest distribution in the $200,000+ income range among all the car brands.

- 17% of their audience is Asian/Asian-American; they have the largest percentage of their users in this demographic group.

- 30% of their customers are female.

- They have a strong presence in California and the Southwest.

- They perform better than other auto brands with individuals having Bachelor’s or graduate degrees.

- Their audience tends to be homeowners as opposed to renters.

- Navigation apps such as Waze, Scout GPS link, Telenav and Google Street View are often used with by their app owners.

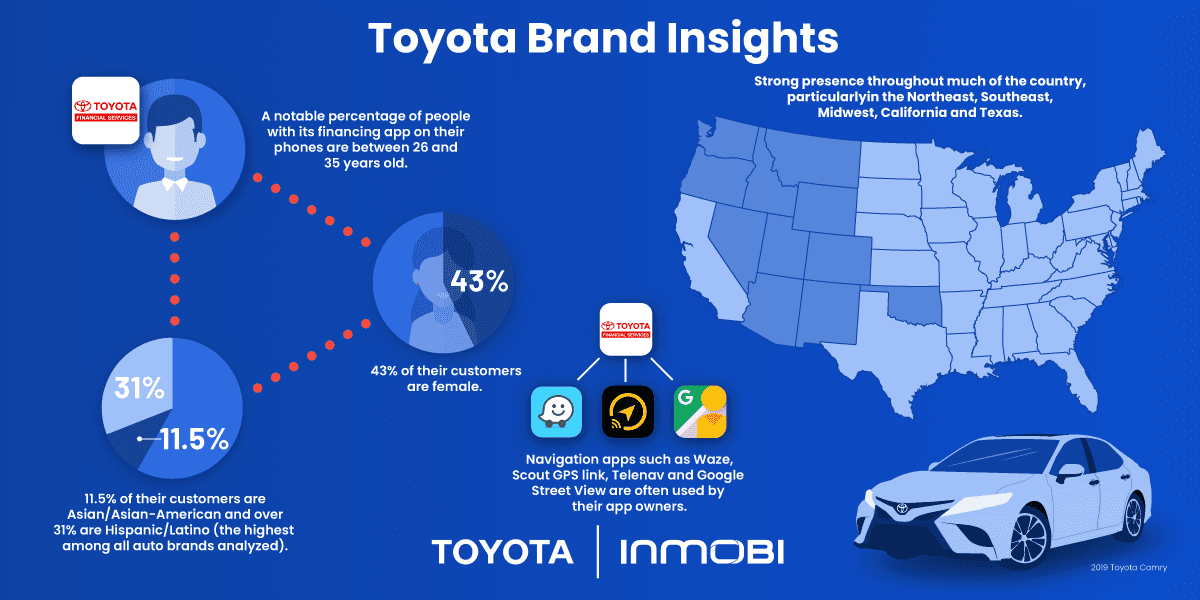

Key Toyota Insights:

- Strong presence throughout much of the country, particularly in the Northeast, Southeast, Midwest, California and Texas.

- 11.5% of their customers are Asian/Asian-American and over 31% are Hispanic/Latinx (the highest among all auto brands analyzed).

- 43% of their customers are female.

- A notable percentage of people with its financing app on their mobile devices are between 26 and 35 years old.

- Navigation apps such as Waze, Scout GPS link, Telenav and Google Street View are often used with by their app owners.

- Older settled lifestyle profiles are likely to be customers.

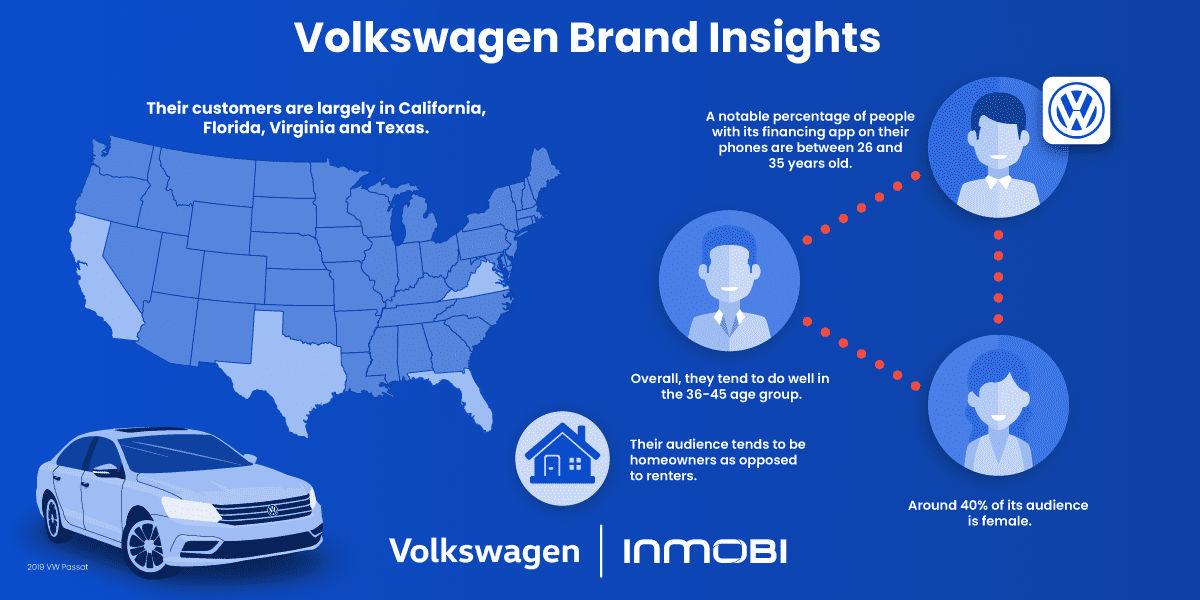

Key Volkswagen Insights:

- A notable percentage of people with its financing app on their mobile devices are between 26 and 35 years old.

- Overall, they tend to do well in the 36-45 age group.

- Around 40% of its audience is female.

- Their customers are largely in California, Florida, Virginia and Texas.

- Their audience tends to be homeowners as opposed to renters.

Highlighting the Users of Car Research Websites

How does the audience of car buyers overlap with the audience looking at the top car buying and car research properties via mobile? Who is visiting these mobile properties?

Gender

- Over half of CarMax site visitors are female, while most car app owners are male. CarMax is the only major car buying site with a majority female audience.

- Three-fourths of AutoTrader and Motor Trend readers are male.

Age

- CarMax performs the best in the 26-35 age group, with around 30% of its audience being in this range. This is a top group for auto finance apps, as Chrysler, Toyota, Volkswagen and Kia Motors have finance apps that are performing well with this segment.

Income

- Carvana and AutoTrader have older, more affluent audiences. CarStory does relative better at lower income brackets, which includes students and retirees.

Location

- TrueCar does well in the Southeast, while CarFax and CarStory do well in the Midwest. CarGurus is more regionally agnostic.

Interests

- Motor Trend users typically follow news and have a high usage of the SuperChevy website, showing keen interest in Chevrolet.

- Motor Trend readers are real car people, highly interested in automobiles and car specifics.

- People going to CarGurus, CarStory and Cars.com use many different car buying properties.

- CarsDirect and CarStory readers are really concerned about the bottom line.

Demographics

- Carvana skews White, but CarStory and CarMax mostly half Non-White.

- A high percentage of Carvana’s audience drives SUVs, lives in the suburbs and can be classified as golden year guardians. A significant portion of the audience for CarFax and CarStory are young couples, young singles and middle class couples.

- Carvana does well with left-leaning voters, small business owners and high-end fashionistas.

How to Use This Data To Inform Your Mobile Ad Campaigns

These insights are interesting, but how can all of this information from InMobi Pulse be used to more intelligently allocate in-app and mobile ad spend?

It’s critical to consider these kinds of characteristics when running a user acquisition or retargeting/remarketing campaign. Every brand’s audience is unique, and is found on certain sites/apps over others. By understanding who their target audience is, what they care about and where they are, automakers can more intelligently allocate their new customer acquisition budgets.

This kind of data can also help inform creatives as well. When running campaigns in apps versus on websites, advertisers may want to make sure that their ads feature people that look like their target audience and are featuring individuals doing activities that their users engage in too.

Curious to see more insights? Reach out today to learn more about InMobi Pulse.

Current State of Auto Advertising on Mobile

In the world of digital advertising, auto is a top spender. According to 2018 figures reported by eMarketer, the automotive industry is second only to retailers in terms of digital ad spending, accounting for a 12.6% share among the 10 industries measured.

Nevertheless, TV is the primary medium for automotive brand campaigns, although spending is expected to take a hit — declining as much as 3% year over year, according to 2018 figures from Magna Global — as automakers experience headwinds due to slumping sales. As a result of this shift, digital channels will be the beneficiaries of those headwinds as the industry moves toward cross-platform spending.

They’re also increasingly targeting mobile - and for good reason. According to eMarketer, automotive industry mobile ad spend in the U.S. is more than 60% of the total digital ad spend of the industry in the U.S. from 2016 to 2020, and is expected to reach close to 68% of the total digital ad spend by the industry by 2020.

The top auto advertisers in the U.S. include General Motors, Ford, Toyota, Chrysler, Honda, Nissan, Hyundai, Subaru, Volkswagen and Kia. These, in addition to newcomer Tesla, are the brands we looked at previously.

There’s a good reason for these brands to be heavily invested in mobile, as the auto research and news properties have a sizable mobile presence. In particular, between April and September 2019, total downloads of the apps for Carvana, CarMax, TrueCar, KBB and Carfax topped 3.2 million in the U.S., according to Apptopia. Increasingly, Americans are turning to their mobile devices and apps to learn more about cars.

While the auto industry’s pivot to mobile advertising is a good sign, that spending will all be for naught if carmakers are not approaching their in-app ad campaigns in an intelligent manner. As our above data notes, each of these brands has a highly specific audience, and these audiences are much more likely to frequent certain websites and apps over others. Auto brands need to truly understand and identify their mobile consumers to drive real connections with their potential consumers.

Our Commitment to Data Privacy: What You Need to Know About This Data

InMobi takes user privacy extremely seriously. We meet the most rigorous governance, compliance, and security standards. We have collaborated with consumer advocacy groups and incorporate guidelines from multiple federal government agencies to define industry-leading practices for data governance in the U.S.

Users retain complete control over the data they provide, have a choice in whether they participate and have transparency as to how their data is utilized. Subscribers have constant access to their privacy elections through multiple telco touchpoints. The patented anonymization platform ensures data sets are 100% secure, and are refreshed to ensure all data are anonymized.

Stay Up to Date

Register to our blog updates newsletter to receive the latest content in your inbox.