- Solutions

- Resources

- About

- Acquiring New Users

- Advertising

- In-App Monetization

Is App Discovery in the App Store Dead?

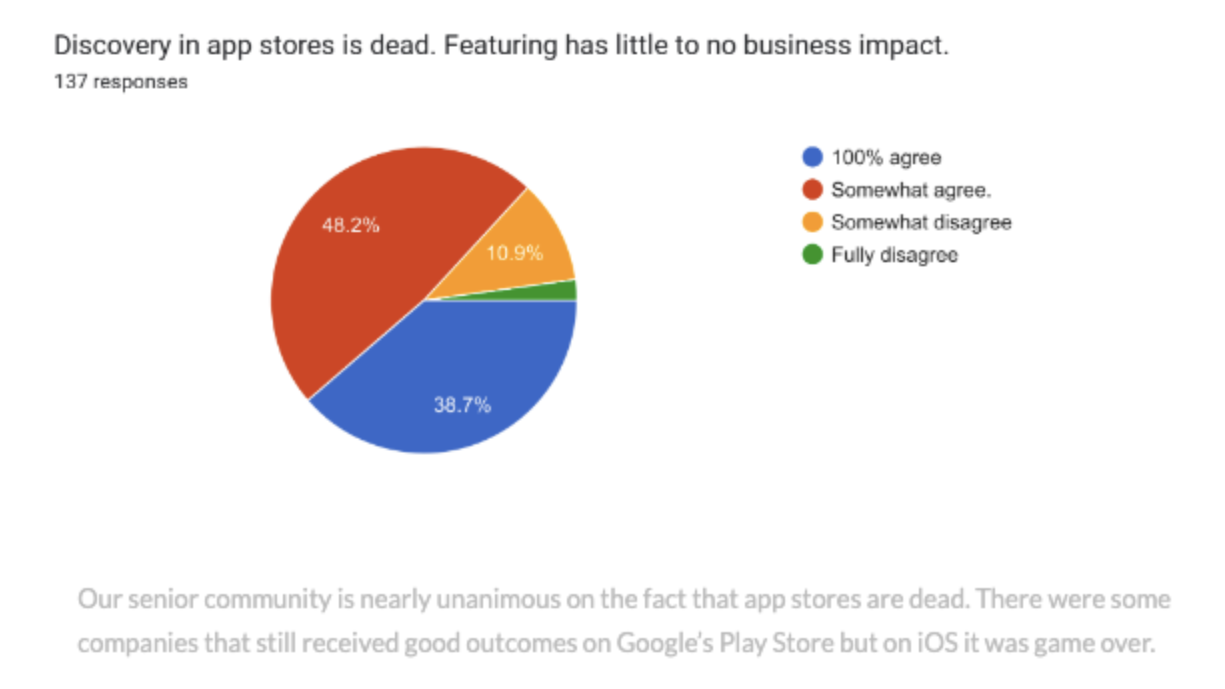

Deconstructor of Fun put a survey question to their audience of senior mobile gaming professionals after predicting that organic discovery on the App Store will die in 2023. The site’s editors proposed that “Discovery in the App Stores is dead. Featuring has little to no business impact.” Nearly 90% of 137 respondents agreed.

App owners are clearly feeling the pinch with App Store discovery, particularly through featured and organic listings. The App Store is an increasingly saturated channel for apps with nearly 1.8m apps and many changes to the user experience in recent times.

At the same time, as an iPhone user, your apps are simply ported from device to device, giving little reason to visit the App Store unless there’s a specific app you want to download. When you do visit, you see a lot of the same apps pedaled over and over across search, charts, and the Today tab.

In fact, Apple’s own App Store Transparency report revealed that the “average weekly number of apps appearing in the top 10 results of at least 1,000 searches” was 197,430. That equates to just 11% of apps in the App Store getting significant search visibility, and you could hazard a guess that a similar 11% of apps are getting significant visibility across the charts and Today tab.

As an app developer, breaking through in the App Store seems to require world class virality or deep, deep pockets. So, let's look into the data to uncover more in answer to Deconstructor of Fun’s question.

What does the data say?

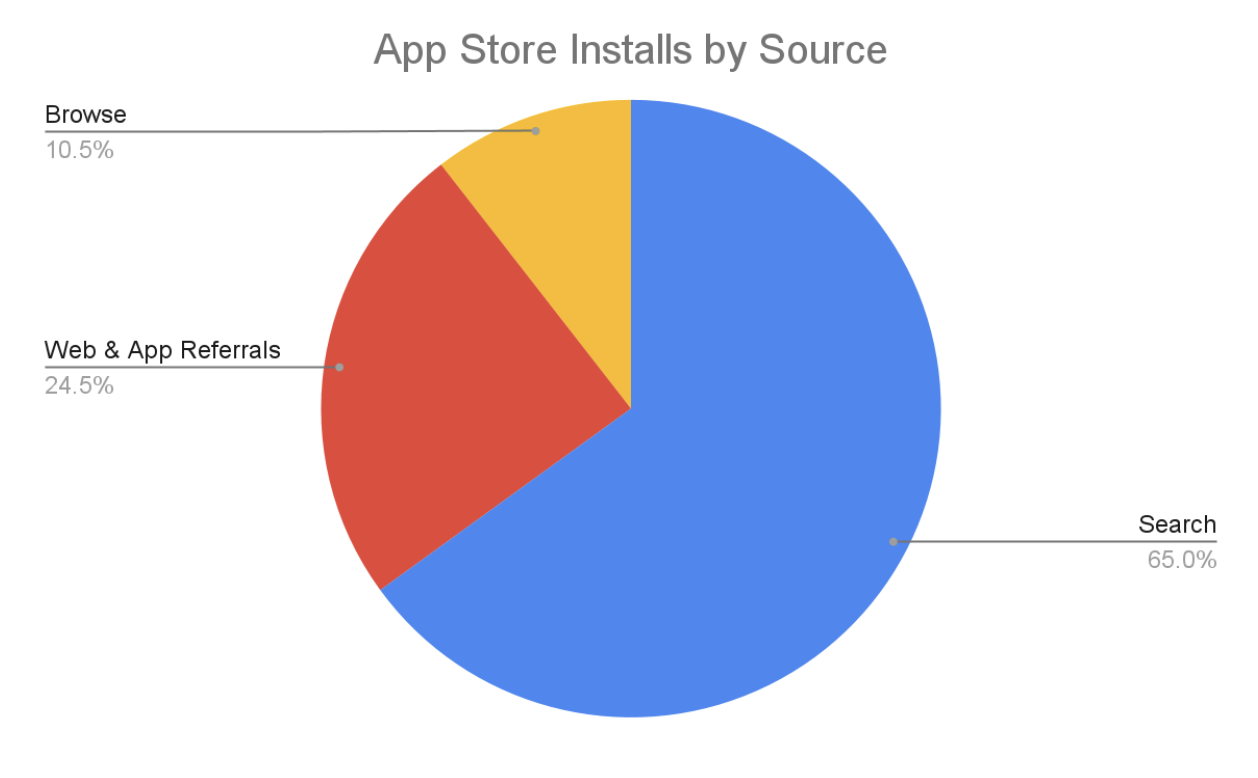

Apple’s own data sources reveal to us some ideas on App Store user flows. Their marketing pages for ads tells us that 70% of App Store visitors use search and 65% of app installs happen after a search. So nearly two thirds of App Store visitors are downloading using the search functionality.

We’ll come back to look at how they’re using search in a minute, but let’s explore what is happening with the other third of users and installs.

If we take a look at the last “App Downloads Source Report” from Sensor Tower in 2021, we see that the ratio of non-search App Store installs is a 70:30 split between referrers (web and app – primarily made up of ads on other channels directing straight to an App Store product page) and browsing (charts and Today tab). If we take this ratio, we end up with an install source split that looks like this on the App Store today:

You can easily understand the Deconstructor of Fun’s survey results when you realize that only 10% of App Store installs are a result of being featured on App Store charts and the Today tab. App installs from browsing are now an inconsequential slice on the App Store, accessible by only a handful of apps.

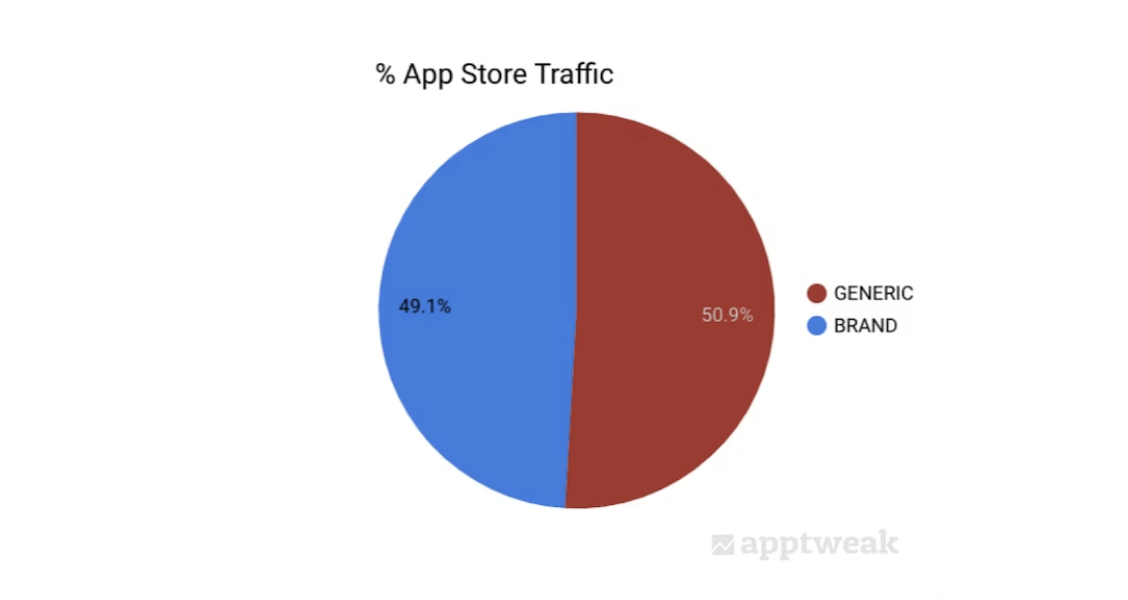

But what about search? Does the search behavior suggest that these are app discovery searches? The answer is that just 50% of searches on the App Store are generic or app discovery searches, according to AppTweak.

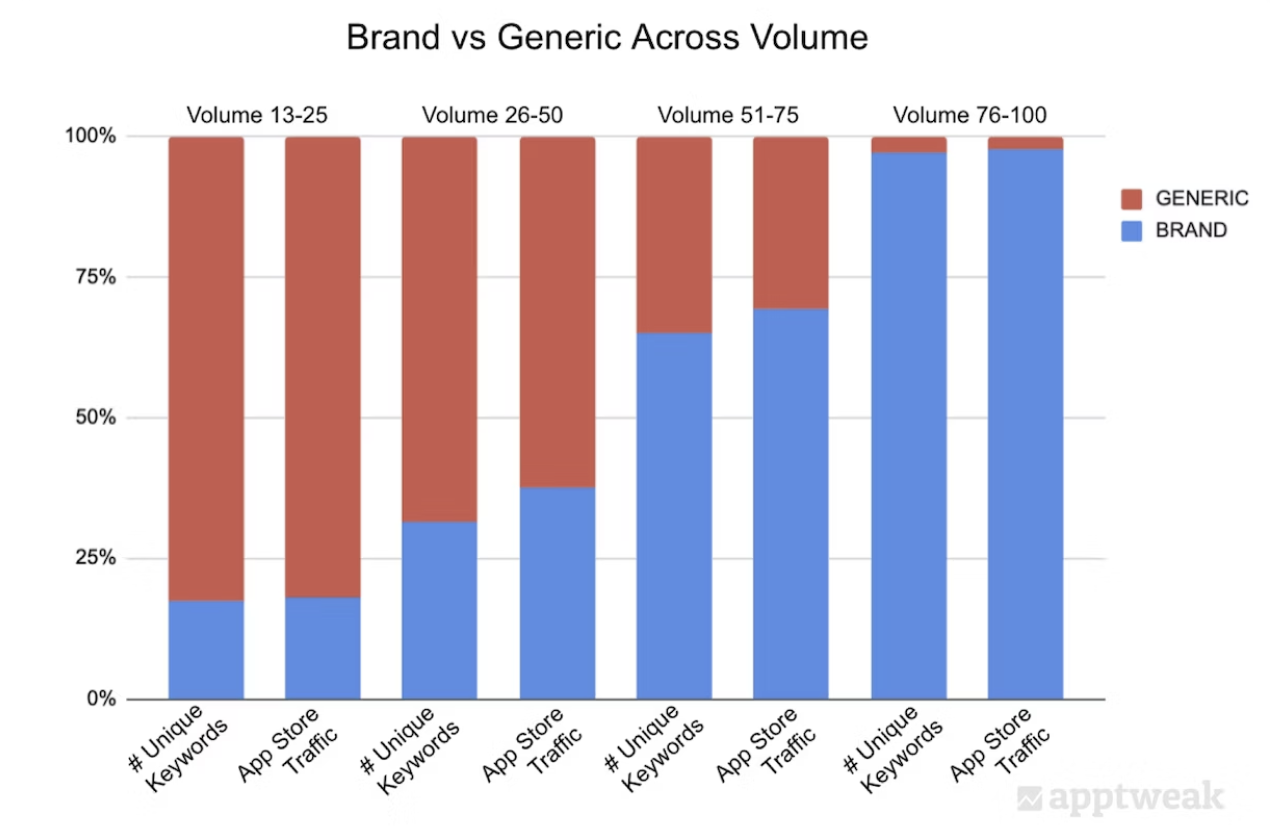

Fifty percent of searches, however, are brand searches, which are essentially users using the App Store search in a transactional way to find an app they want to download. Generic searches are also majority long-tail, with head (high volume) terms being almost entirely branded as you can see below.

This means that the volume of generic terms that are relevant or high intent to convert for a given app are likely to be low.

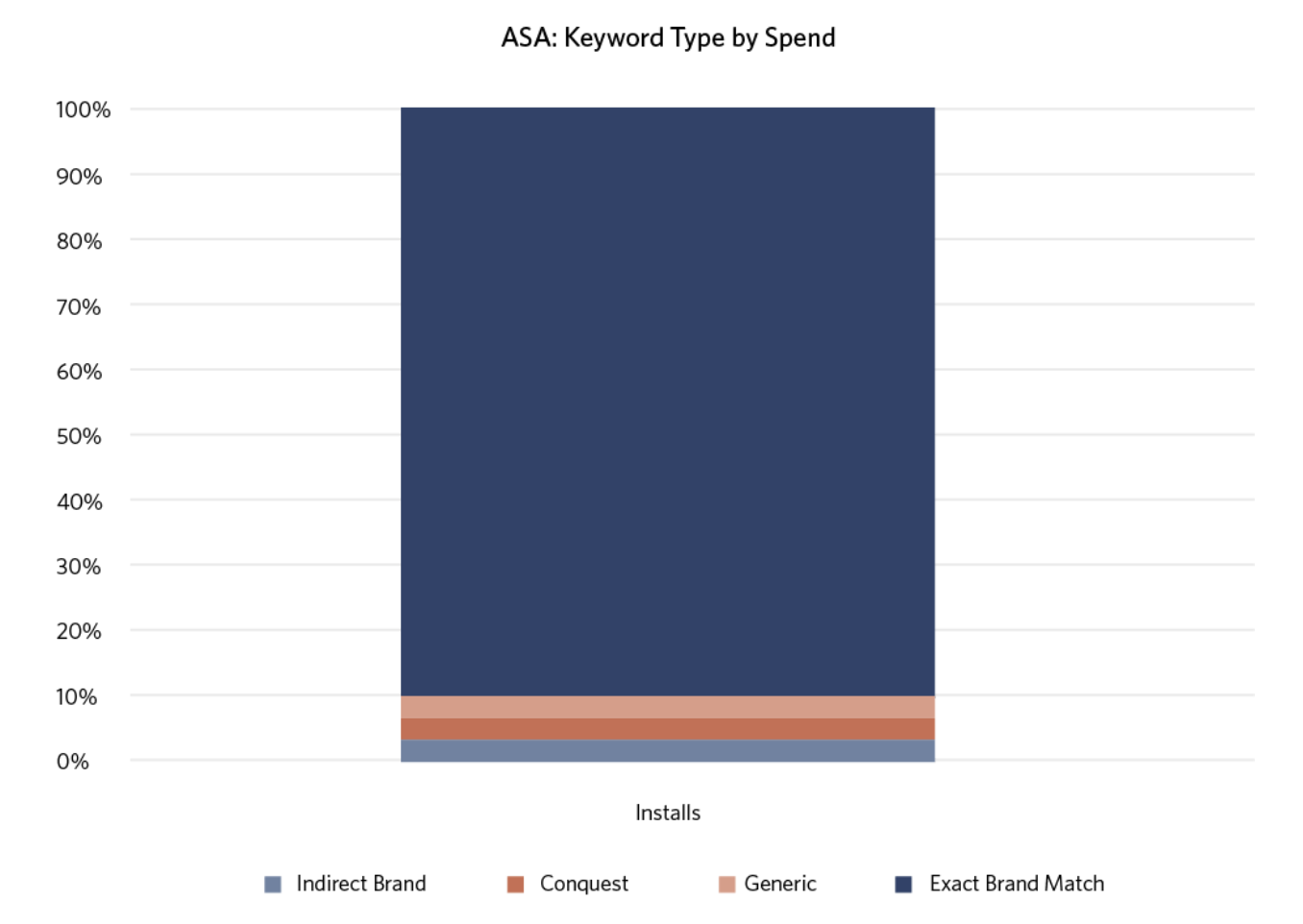

As you would guess, the intent behind a brand search is also much higher, leading to more installs coming from branded search terms. In one study by Kochava with anecdotal data from a single advertiser: “A streaming entertainment brand we’ve all heard of … that is likely front of mind for most users in the U.S. when they think of ‘Entertainment Media’” Kochava reports that this app saw 95% of Apple Search Ads (ASA) attributions from their own brand term.

So, for big brands, a large majority of installs from App Store search are coming from their own brand terms. While for smaller brands this percentage is likely to be lower, the higher conversion rate does lead you to the assumption that the majority of App Store search installs are coming from brand terms. This means that there isn’t a huge amount of app discovery happening via search either. The App Store is fast becoming a mobile vending machine where users largely go to download apps they already know that they want.

What does this mean for advertisers?

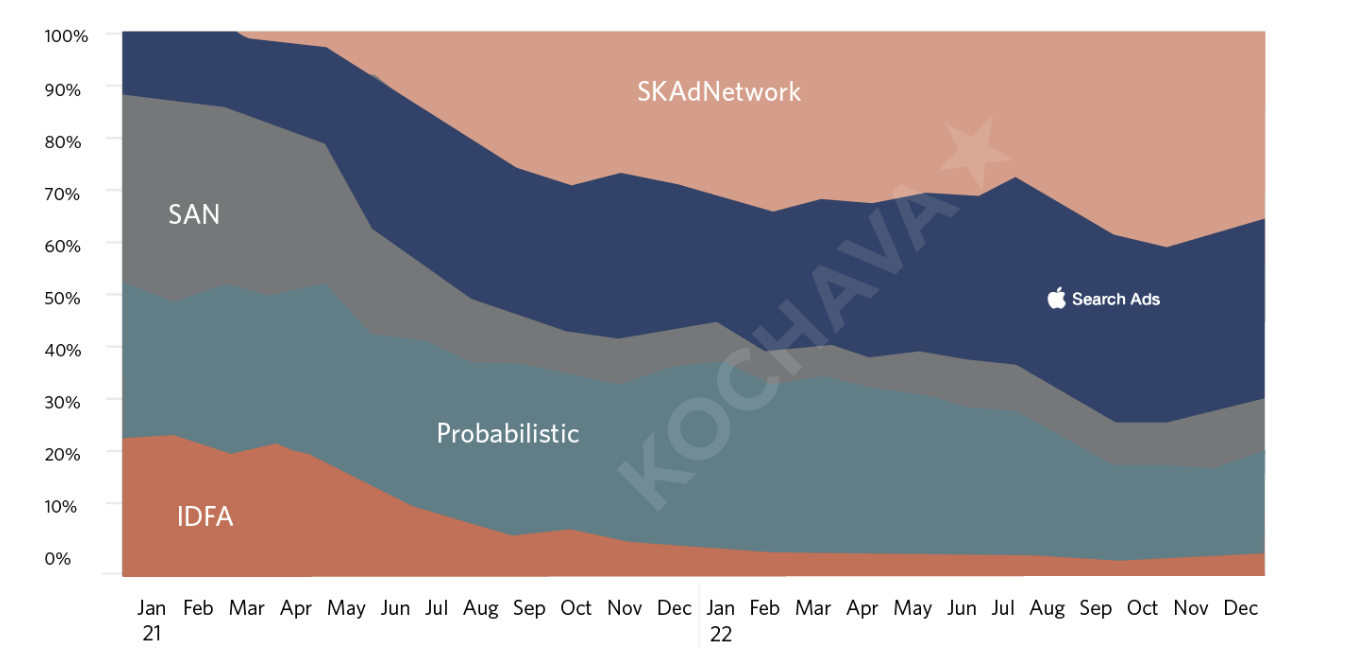

Since the rollout of SKAdNetwork (SKAN) in Spring 2021, Apple’s own Search Ads business has undergone a meteoric rise.

Appsumer, InMobi’s cross-channel optimization platform, found that Apple Search Ads share of app install advertising spend on iOS had increased 16 percentage points since the App Tracking Transparency (ATT) rollout to 45%.

Similarly, Kochava found that Apple Search Ads had benefited from how media attribution has been redistributed over the past two years in the iOS advertising ecosystem.

Only SKAN attribution is operating at a similar scale to Apple Search Ads, while probabilistic attribution (fingerprinting) is close behind in terms of scale. However, probabilistic attribution / fingerprinting will be disappearing off the iOS map by early next year.

So why is Apple Search Ads so popular?

If we break down the main reasons, they are:

- Attribution advantage: Any channel that could continue business as usual post-ATT was going to be a popular choice for advertisers. That’s why many advertisers shifted budget to the unaffected Android OS and on iOS towards Apple Search Ads. As a first-party platform on iOS, Apple Search Ads did not have to succumb to the complex and, at the time, incomplete SKAN attribution framework. They could continue business as usual using their AdServices attribution. In addition to this advantage, Apple Search Ads also applies a somewhat overzealous 30-day click attribution window for them to take credit for a conversion versus a more standard 7-day click attribution lookback window applied by MMPs to other channels on iOS.

- Last-click advantage: With a majority of search installs coming from brand terms, Apple Search Ads is much more of a demand capture than a demand creation channel, much like Google search on the web. It’s the natural user experience on the App Store. A friend has recommended it, you’ve seen ads in another app, you’ve seen a TV ad, you’ve seen a video, and it’s the app you need to control a piece of hardware you bought, etc. Whatever the demand creation source for an app, you go to the App Store to download it, which means that as an advertiser, you have to defend your brand term with Apple Search Ads to stop competitors from stealing the click so that’s what gets conversion credit.

This is all to say that when you, as a performance advertiser, need to fire up a channel on iOS where the numbers are going to stack up, Apple Search Ads is a safe bet. A bit like IT Directors who never got fired for choosing IBM. You won’t get fired for the CPA numbers coming back from Apple Search Ads. However, what impact is it actually having in terms of increasing demand for your app?

How should you look at investments in Apple Search Ads?

With all this in mind, there are some important considerations for iOS user acquisition strategies to consider:

Make sure you cover the basics

Given that a huge amount of potential App Store installs will come from your brand term, you will likely want to cover off your brand term. This will particularly be the case if you’re in a highly competitive segment where competitors are likely on the attack. However, it’s important to do a lift test to understand what percentage of paid installs are cannibalizing organic installs on your brand term. A few years ago when Gabe Kwakyi was at Incipia, he said this of brand cannibalization on ASA:

“The incrementality/cannibalization percentage is impossible to calculate with 100% certainty, but our research estimates that Apple Search Ads brand ad incrementality is ~40% (i.e. 60% cannibalistic).”

Once you have established this, it’s important to recalculate your real CPI by deducting cannibalized installs and dividing your brand keyword spend by the recalculated install numbers.

Brand Keyword Spend

(Total installs - cannibalized installs)

This makes it easy to understand when brand bidding becomes unsustainable. Another useful metric for understanding the cannibalization of your own brand bidding is to follow the calculation that Simon Thilley from AppTweak highlights in this article for Cost Per Protected Install (CPPI).

In some categories, particularly multi-install markets like dating, you may also want to consider bidding on competitor brand terms to squeeze some discovery out of the App Store where bigger competitors exist. Equally doing exact match on tightly curated generic keywords and a small exploration campaign on broad match should cover off on the remaining generic terms you might have missed that are high intent.

Once you have covered these basics, there’s really not much more to do in terms of campaign and budget expansion on Apple Search Ads.

Compare apples-to-apples attribution on iOS channels

Three things are happening that are painting an unrealistic picture of attribution on iOS and performance advertisers need to adjust for:

- Ad Services: The Ad Services attribution framework that is attributing Apple Search Ads installs has a 30-day click-through attribution window versus the 7-day window that your MMP is likely setting for other iOS channels. Work on correcting this when you’re analyzing iOS performance to ensure that you’re not over attributing to Apple Search Ads and under-attributing to other channels.

- SKAN privacy thresholds: Privacy Thresholds on SKAN are a volume of installs per campaign per day that need to be met in order for parts of a SKAN postback to be sent. For many advertisers, particularly on the smaller end of the scale, a lot of postbacks are lost to this on some channels. This leads to a significant undercounting of installs and a higher CPA, which again paints Apple Search Ads in a better light. It’s important to model null postbacks to ensure that all channels are getting the due credit they deserve.

- ASA last-click advantage: Much like search on the web, Apple Search Ads holds a significant last-click advantage given the mobile vending machine nature of the App Store. With this in mind, it’s increasingly important to use econometric models such as incrementality and Media Mix Modelling (MMM) to ensure credit is being given across the funnel and Apple Search Ads spend increases are providing incremental value, not just cannibalizing other channels.

Apple Search Ads can’t be your entire iOS strategy

A popular iOS user acquisition strategy post ATT has been to simply plunge the entire iOS budget into Apple Search Ads. The reality is you can’t build an entire app user acquisition strategy by investing your whole budget into demand capture channels..It will rapidly result in diminishing returns for an app advertiser as the demand to capture dries up.

Performance advertising needs to cover both demand capture and demand creation channels. This is why InMobi has invested so heavily in building the industry's first and only bidder for SKAN on iOS. With 64% of user time spent outside apps owned by major Self-Attributing Networks (SANs) and the high-value iOS user-base, we have built performant targeting to build demand for your app on iOS in the open app ecosystem. Advertisers have seen 16x more installs coming via InMobi’s SKAN bidder versus other iOS channels at a CPI 94% lower.

With lower competition and highly affluent users available across SKAN inventory, it’s an important time to develop your SKAN targeting strategy. To discuss your iOS strategy outside of ASA, get in touch with us at performance@inmobi.com.

Stay Up to Date

Register to our blog updates newsletter to receive the latest content in your inbox.