- Solutions

- Resources

- About

- Advertising

- Consumer Research

- Understanding Consumers

Q4 2021 U.S. Retail Mobile App Trends You Need To Know

As we head into the busiest time of the year for retailers in the U.S., what are the biggest retail mobile app trends? With brands and retailers increasingly pushing consumers to download and use their own mobile apps to make purchases this holiday season, who specifically should they be targeting in their app marketing strategies?

To find out, we looked at the data. Using our first-party data sources, we looked at who the current app users are across a number of key retail shopping categories.

Retail App Insights: Top Mobile Trends

- The brands that have invested in their apps instead of or in addition to their mobile websites are the ones seeing the greatest growth in app installs of late. This list includes Amazon, Walmart, Target and Best Buy, which are among the top 10 companies in the U.S. based on retail e-commerce growth and sales according to eMarketer.

- Across most retail categories, including dollar stores, app owners tend to be women. This is unique, as app owners in most categories tend to be men.

Current Retail Mobile Shopping Apps Install Trends

Overall, what kinds of trends are we seeing in regard to app installs for major retail categories? Here’s what the data highlights for the toy, home electronics, apparel and beauty sectors.

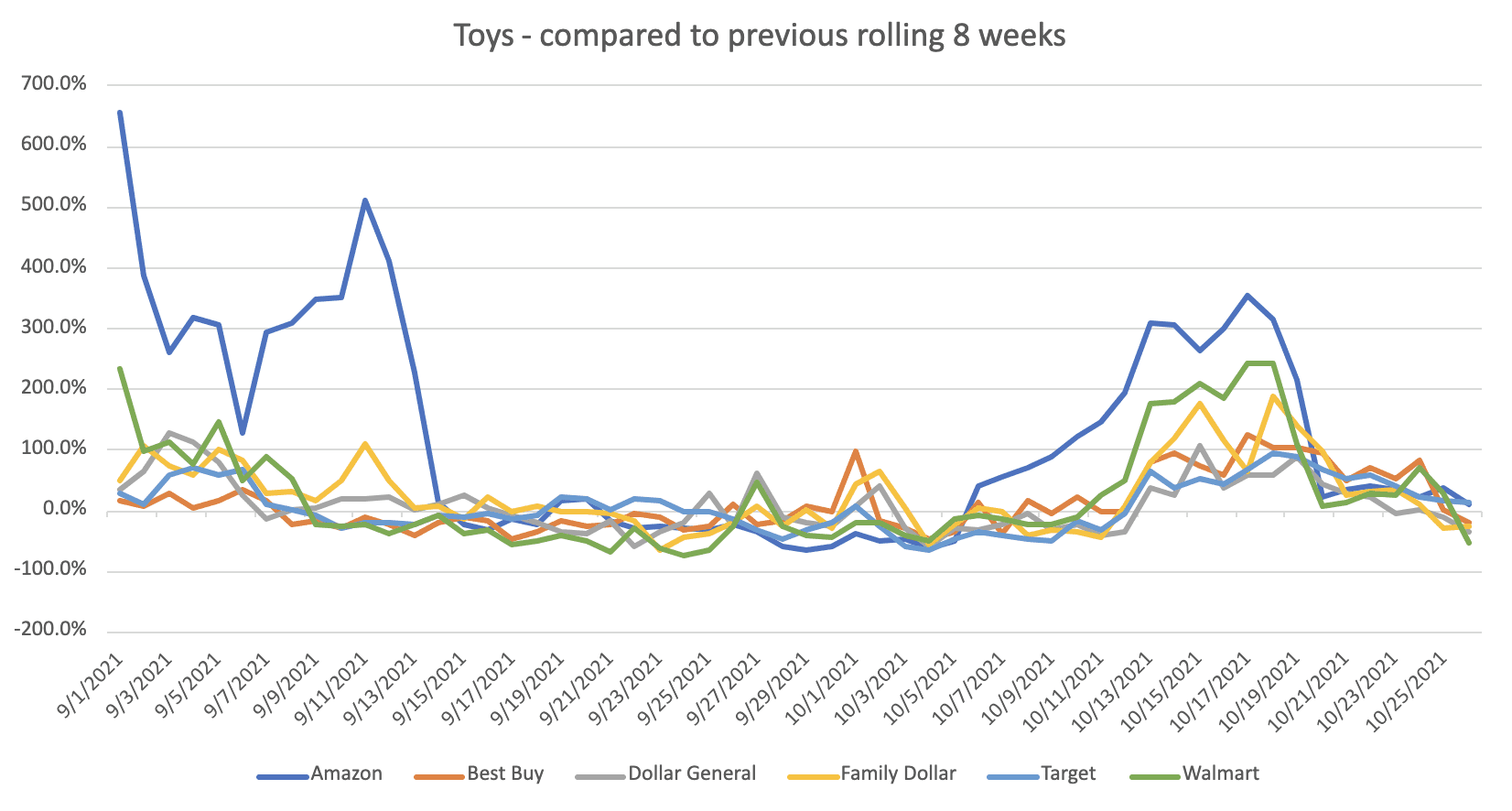

Toys

Daily net installs are on the rise for Amazon and Walmart. Other brands have experienced some recent lifts but are largely flat.

Compared to 2020, September installs are down. The trends we’re observing for October 2021 are on par with what we saw in October 2020 for app adoption for most of these brands, with adopting being especially strong for Family Dollar, Dollar General and Amazon.

Installs during the past eight weeks are on the upswing compared to the preceding eight weeks. What this means is that adoption is increasing at an increasing rate.

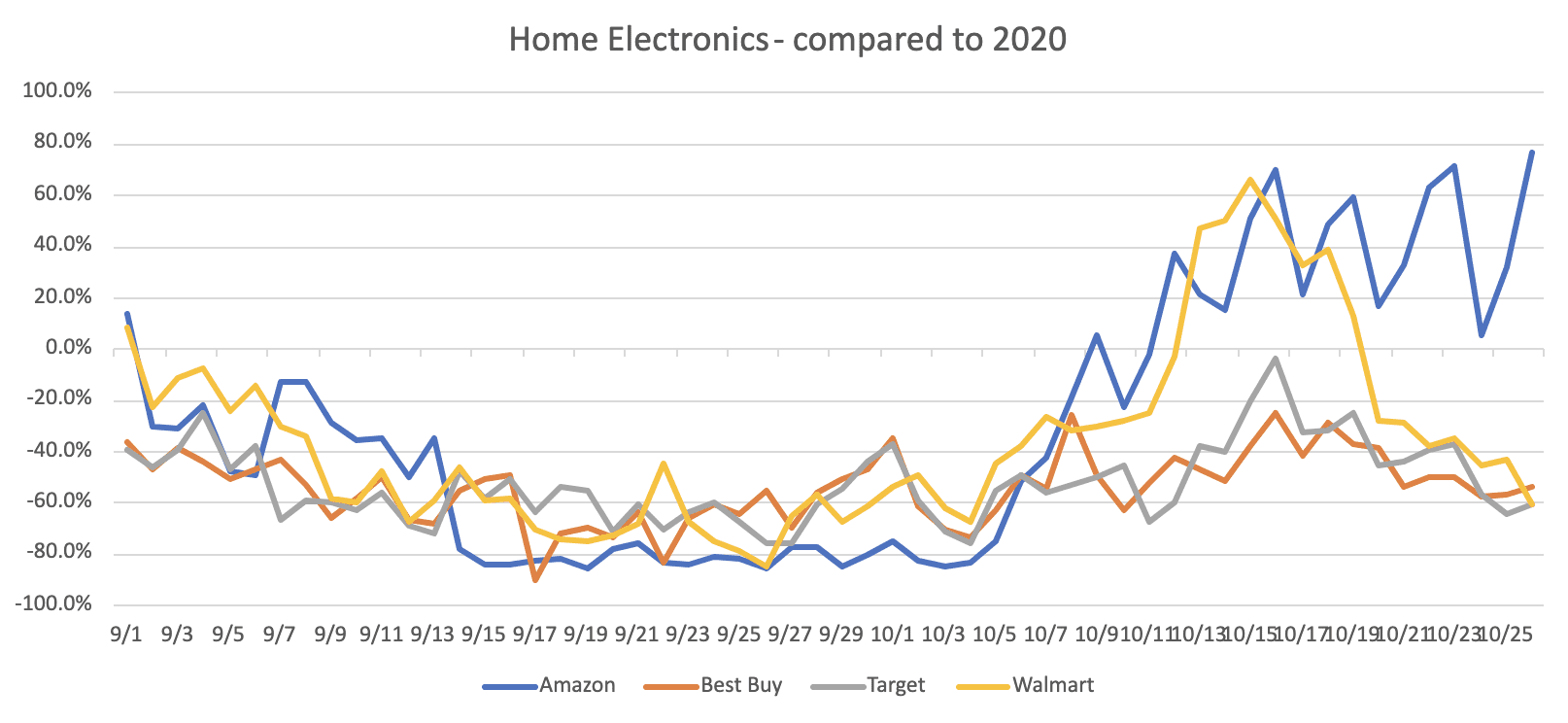

Home Electronics

Daily net installs are on the rise for Amazon and Walmart. Other brands are largely flat.

Compared to 2020, September installs are down. October 2021 drover stronger install growth than 2020 for Walmart and Amazon, but Best Buy and Target still lag behind 2020 adoption despite recent growth.

The past eight weeks of installs show an uptick in adoption in mid-October compared to the preceding eight weeks. This means adoption is increasing at an increasing rate.

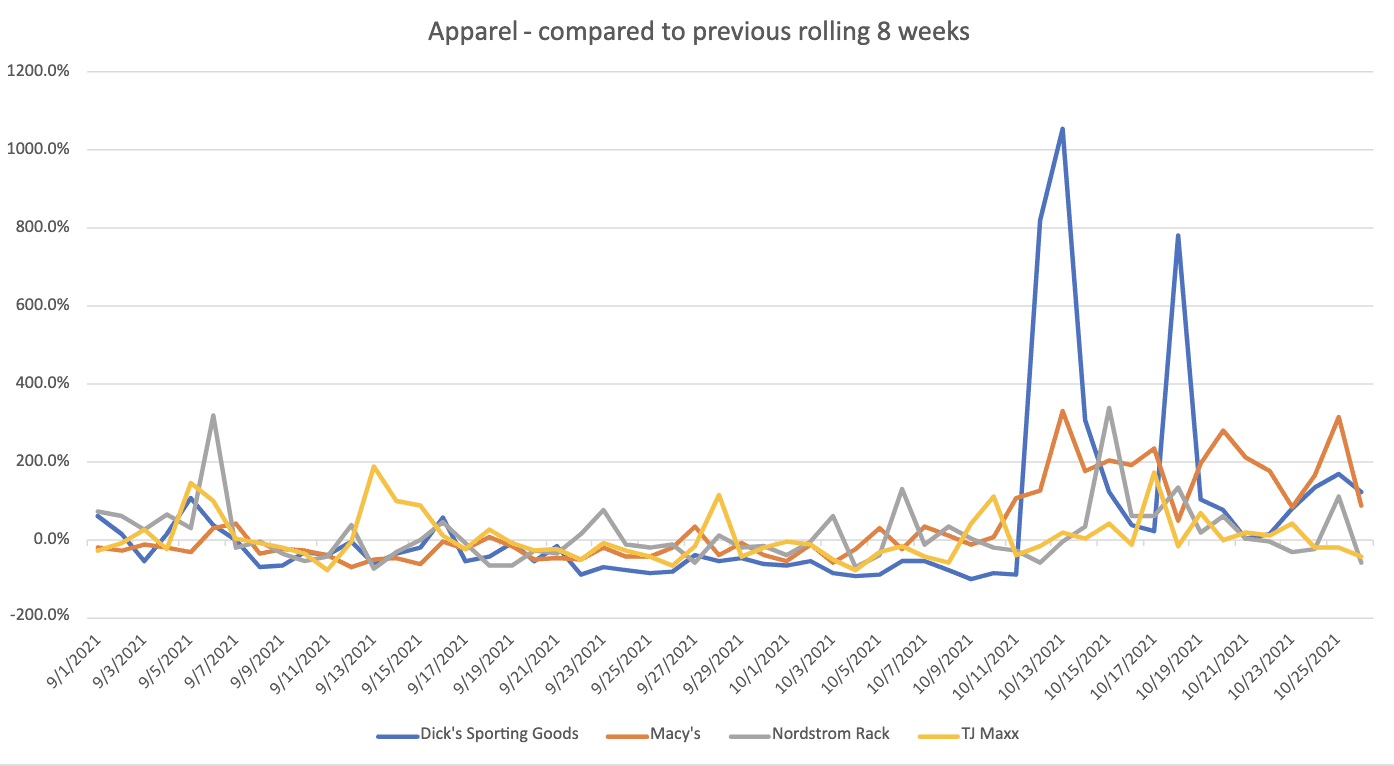

Apparel

Daily net installs are on the rise for apparel brands. But, except for Dick’s Sporting Goods, 2021 net installs are flat compared to 2020.

What differentiates Dick’s in this space? They ran a 20% coupon that successfully drove installs in late September.

Still, this category is on the upward swing of late. The last eight weeks of installs shows a strong lift in October adoption compared to the preceding eight weeks. For major apparel brands, adoption increased at an increasing rate in October.

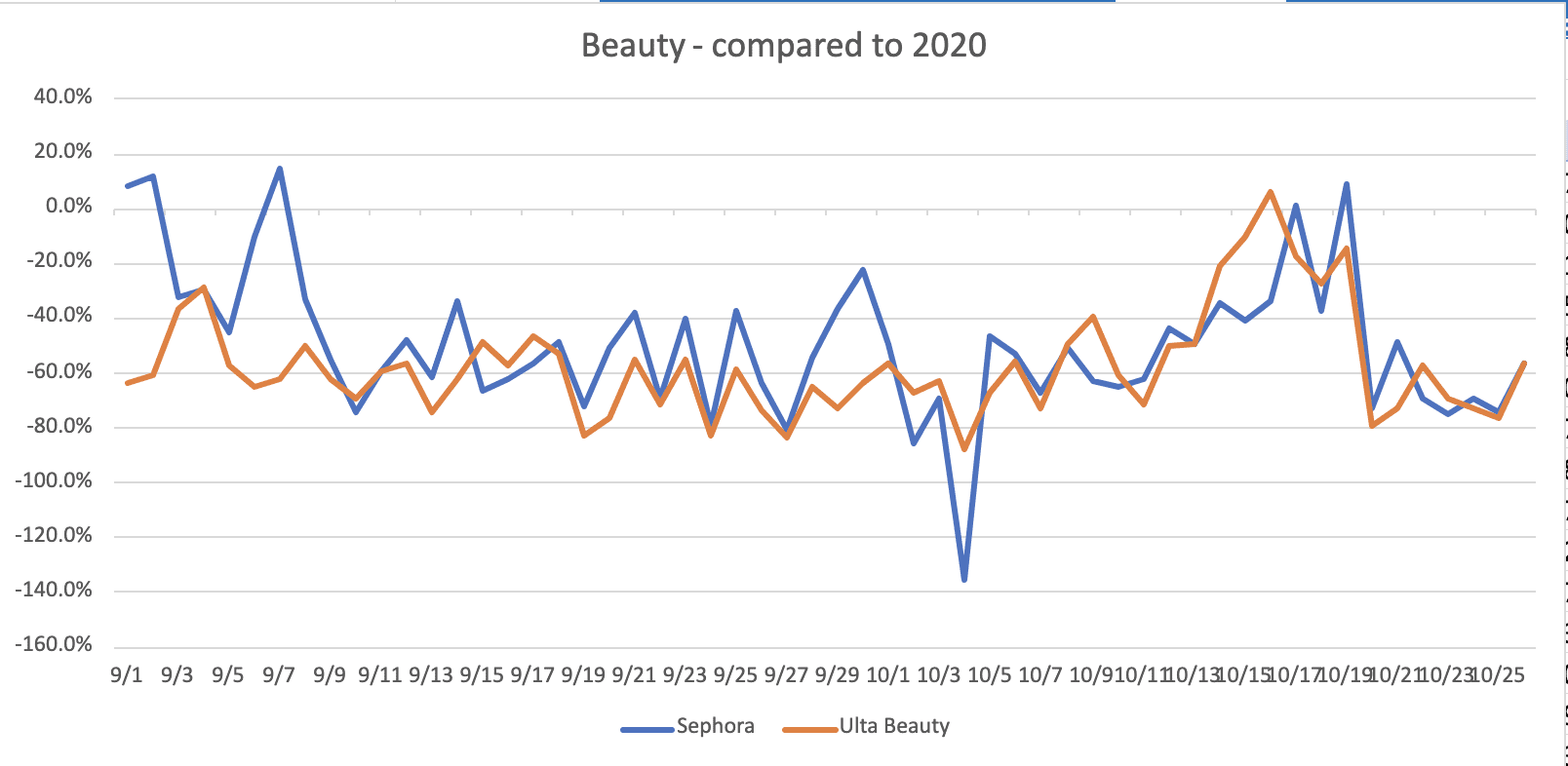

Beauty

Daily net installs for Sephora and Ulta are growing in September. Ulta is growing at a stronger rate than Sephora, however.

Both apps have seen their net install numbers spike and dip in 2021. Why? These fluctuations are likely due to app-related promos.

Compared to 2020, installs in September and October 2021 are down with the exception of a couple very small lifts in early September and mid-October. Overall, installs in the past eight weeks are flat, with similar growth to the eight weeks prior.

Who Has Retail Apps On Their Mobile Devices Today?

What kinds of shoppers have these retail apps on their smartphones and tablets? To explore this question further, we turned to the data. Here’s what we uncovered about retail app ownership trends in the U.S. in October 2021.

- Dollar Store Apps: Compared to the U.S. population at large, people with either the Family Dollar or Dollar General apps are more likely to be women and more likely to make less than $75,000 a year. Over a quarter of all Family Dollar app owners are Black.

- Toys and Electronics: Most Target and Walmart app owners are women, while the majority of Best Buy and Amazon app owners are men. For Walmart, Target and Best Buy, between one in five and one in four app owners are between the ages of 26 and 35. For Amazon, however, 44% of app owners are over the age of 55.

- Apparel Apps: Over two-thirds of Macy’s and Nordstrom Rack app owners are women, while 57% of those with the Dick’s Sporting Goods app on their mobile devices are men. For all three apps, around half of all app owners are between 36 and 55 years old.

How Retailers Should Approach App-led Shopping Experiences This Holiday Season

As retailers head into the thick of the holiday shopping season in the U.S., how should they be thinking about their apps? Specifically, how can apps help facilitate a seamless customer experience, and how can retailers lean into app-commerce this year? Based on the data, here are some of our top recommendations:

Highlight how the app makes it easy to buy, period. While some consumers will prefer to shop online, others may prefer to browse and buy at brick-and-mortar stores – and still others will want to pick up their digital shopping cart purchases in a physical store. Consumers want choice and ease this holiday shopping season; brands that highlight how their apps give consumers choice will see both strong app adoption and strong sales as a result.

- Focus on your best audiences. Looking to see quality conversion rates from your app marketing? Don’t try to boil the ocean. As our data shows, different retail segments have very different core audiences. This holiday season, retailers should focus on their best audiences as opposed to trying to get everyone to download and use their app.

This is just a small sample of the insights we have generated leading up to the 2021 holiday shopping season. For more detailed insights, including data unique to you, reach out today to schedule a chat.

What do you think the 2021 holiday shopping season will look like, and what will brands and retailers need to do in order to see success this year? Let us know your thoughts on the topic on social media! Whether you want to talk about macro m-commerce trends or even the fine points of push notifications, you can reach out to us on LinkedIn, Twitter, Facebook or Instagram.

About the Author

Matthew Kaplan has over a decade of digital marketing experience, working to support the content goals of the world’s biggest B2B and B2C brands. He is a passionate app user and evangelist, working to support diverse marketing campaigns across devices.

Stay Up to Date

Register to our blog updates newsletter to receive the latest content in your inbox.