- Solutions

- Resources

- About

- Consumer Research

- Media Consumption & Trends

- Understanding Consumers

Top Retail Mobile App Statistics You Need to Know in 2020

With the critical holiday shopping season approaching in the United States, here are the key retail mobile app statistics you really need to know. By answering these questions, we take a deep dive into the habits and actions of these smartphone users.

1) Who Are These Mobile App Users?

For a deep dive into who was using the top retail Android and iOS apps, we turned to the data. Specifically, we used InMobi’s first-party mobile data to look at who had the Walmart, Amazon, eBay, Wayfair, Target, Walgreens, Etsy, CVS, Kohl’s, Disney Store, Best Buy, RetailMeNot and/or Zulily apps on their mobile devices.

- Perhaps unsurprisingly, the majority of those with these apps are women. Overall, 55% of recent app installers were female.

- 61% of recent app installers were White.

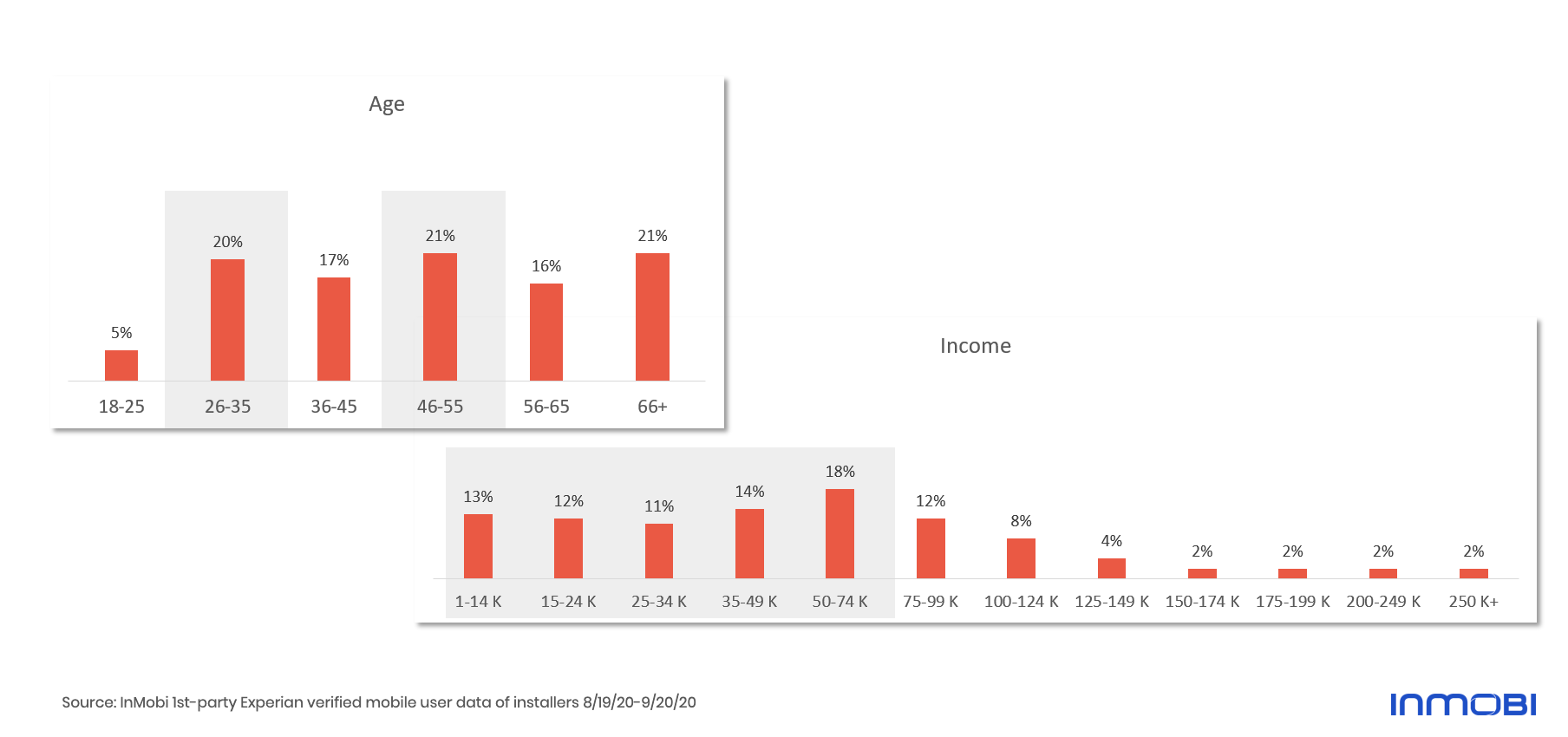

- The bulk of recent retail and e-commerce app installers are in middle- and lower-income brackets. Two-thirds make less than $75,000 a year annually.

- In terms of age, 22% of recent app installers were between 46 and 55 years old, while 20% were between the ages of 26 and 35. In addition, 35% were over the age of 55.

2) How Do Users of Retailer Apps Differ from Users in Other App Categories?

Interestingly, retail app installers look very similar to those who had downloaded apps to purchase consumer packaged goods (CPG) recently. Between July and September, people who had installed popular apps to buy CPG items, including Drizly, Instacart and Walmart, were also majority female, majority White, of similar ages and mostly in the middle- and lower-income ranges.

There were similar trends observed with consumer-to-consumer (C2C) marketplace apps like Letgo and OfferUp. In our analysis of that space from 2019, we found that many C2C app owners were also female, White and with annual incomes under $75,000.

Many of these retail app users can also be found playing popular mobile gaming apps. In particular, our analysis of popular hyper casual games showed that many of those playing popular mobile games are also female and White. In addition, many were either between 26 and 35 years old or older.

Interestingly, those who had installed major retail apps of late are different than those who have downloaded consumer electronics retail apps recently. In the consumer electronics space, most retail app installers are male and wealthier.

3) Will Shoppers Use Mobile Devices To Buy Holiday Gifts in 2020?

According to the latest stats from App Annie, mobile is playing a larger role than ever before in the shopping experience. In particular, App Annie has found American consumers spending a total of 1 billion hours shopping on mobile, an increase of 50% year over year in time users spend shopping on their mobile devices.

While a significant chunk of this growth is happening because of COVID-19 and the drive to limit out-of-home shopping, it is key to note that these trends were well under way even before the year began. For example, at the end of 2019, Business Insider predicted retail mobile payments to be greater than $280 billion in the U.S. alone.

However, App Annie did note that when consumers will be using mobile for retail shopping will look different this year. In the past, a lot of e-commerce spending happened right at the beginning of the holiday shopping season, specifically on Black Friday and Cyber Monday. But considering the state of the global economy and recent moves by Amazon, mobile retail spending is expected to be more spread out in 2020 than it has been in years past.

4) Will M-Commerce Consumers Use Mobile Websites or Apps?

All told, total global mobile app revenue is expected to equal close to $582 billion in 2020. But, none of the top 10 grossing apps are retail apps. So does that mean that most mobile commerce is happening on mobile websites over apps?

Not at all. In fact, our research from both the summer of 2020 and the 2019 holiday shopping season shows that consumers are increasingly gravitating towards a number of apps to both learn about products and to make purchases.

However, there are some interesting wrinkles to the retail mobile app space:

- The Google Play Store is driving a lot of this m-commerce growth, with App Annie noting major increases in usage on mobile devices using the Android operating system.

- Amazon thoroughly dominates the shopping app category, although other retail apps are seeing growth.

- Americans will be using retail mobile apps primarily to buy clothing, shoes, jewelry and accessories this holiday shopping season.

5) How Can Retailers Drive App Downloads?

With app-based m-commerce expected to rise, retailers need to put themselves in the best position possible to capture these sales. As a result, it’s critical that retailers drive both downloads and usage of their mobile apps, while also keeping app and shopping cart abandonment rates low this holiday season.

So what are some ways these retails can drive app downloads? In-app advertising can always help for user acquisition, along with other marketing strategies. There’s a reason why eMarketer predicts retail digital ad spending to be greater than $28 billion in 2020.

Retailers are going to be very aggressive this year with their digital offerings – even more so than in the past. The fact that major retailers like Walmart and Target are not opening on Thanksgiving Day for the first time in recent memory shows how retailers are further prioritizing digital shopping channels in 2020. This may help set the tone and urgency with other brands and their agencies.

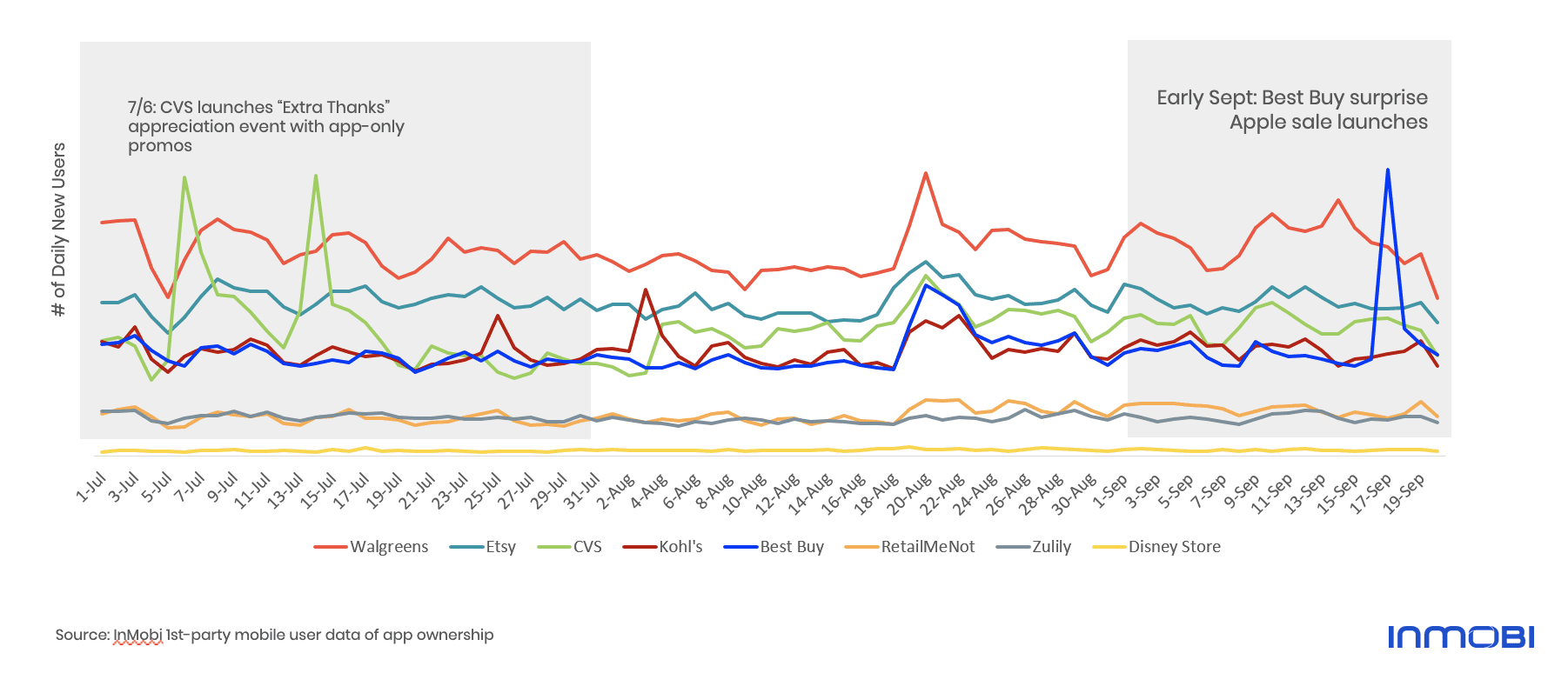

Specials and app-specific offers can help a lot too. In fact, in looking at daily app install trends over the summer, brands like CVS and Best Buy had the best results when they launched exclusives and app-first offers.

Already, brands are following this example. For instance, Home Depot announced two months ahead of Black Friday that they were offering discounts staring in early November, while Best Buy is planning promotions earlier this year than in the past.

Did any of these data points surprise you? What role do you think apps will play this holiday shopping season? Let us know on social media! Send us your comments on Twitter, LinkedIn and/or Facebook.

Interested in learning more about mobile shopping habits? Want to conduct your own mobile-first research campaign? Reach out today to learn more about InMobi Pulse and its many capabilities.

About the Author

Matthew Kaplan has over a decade of digital marketing experience, working to support the content goals of the world’s biggest B2B and B2C brands. He is a passionate app user and evangelist, working to support diverse marketing campaigns across devices.

Stay Up to Date

Register to our blog updates newsletter to receive the latest content in your inbox.