- Solutions

- Resources

- About

- Advertising

- Inside InMobi

- Media Consumption & Trends

Six Months Of ATT: The Story Behind The Numbers

It has been nearly six months since Apple started enforcing App Tracking Transparency (ATT) changes with their iOS 14.5 update. Since the release, we have seen buyers, publishers and ad tech ecosystem partners pivot and adapt to these changes in various ways.

In this blog, we would like to show some stats and observations from InMobi’s point of view, including how InMobi fared and some reasons that explain the trends we see.

Top Three Trends from InMobi Exchange

1) User opt-in rates are better than original estimates

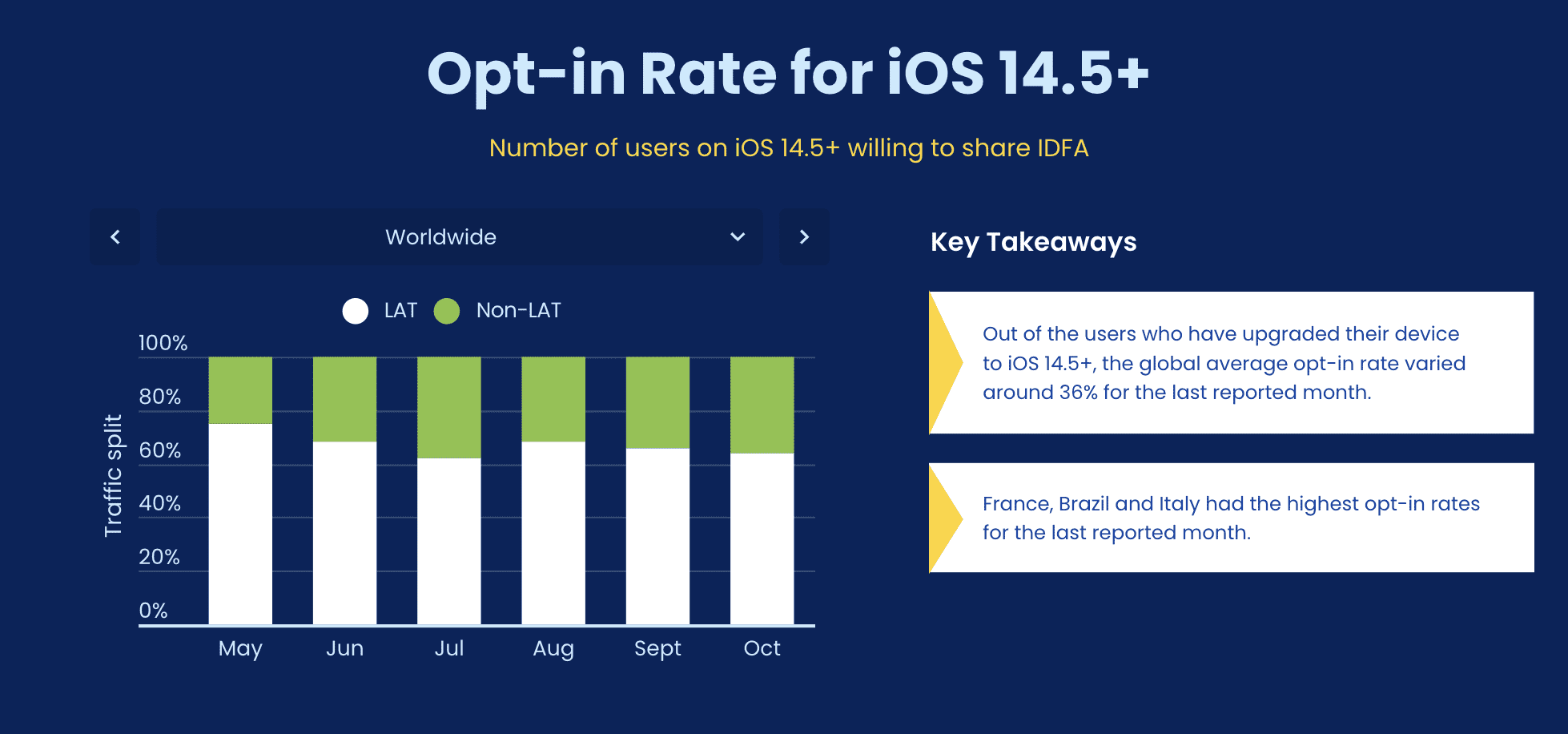

Apple rolled out the iOS 14.5 update in late April, and we started to see an increase in Limit Ad Tracking (LAT) traffic, i.e., traffic without IDFAs, soon after.

While opt-in supply (for versions iOS 14.5 and above) was about 25% of InMobi supply in May, it increased over the next few months and has stabilized to around 34-36% in the most recent months. The user opt-in rates have been more encouraging than the original industry estimates of around 25% or lower.

ATT opt-in rates (overall)

What explains the opt-in rates increase and then subsequent stabilization?

Apple’s iOS 14.5 update in April rolled out more gradually than their usual OS updates. But as the rollout accelerated in May, all users on all apps were automatically classified as LAT users until publishers got users to respond to their ATT prompt.

Publishers tested variations of ATT prompts by tweaking the messaging, prompt timing, etc., before scaling to their entire user base. This testing allowed publishers to increase their opt-ins over time.

2) Users are evaluating value exchange

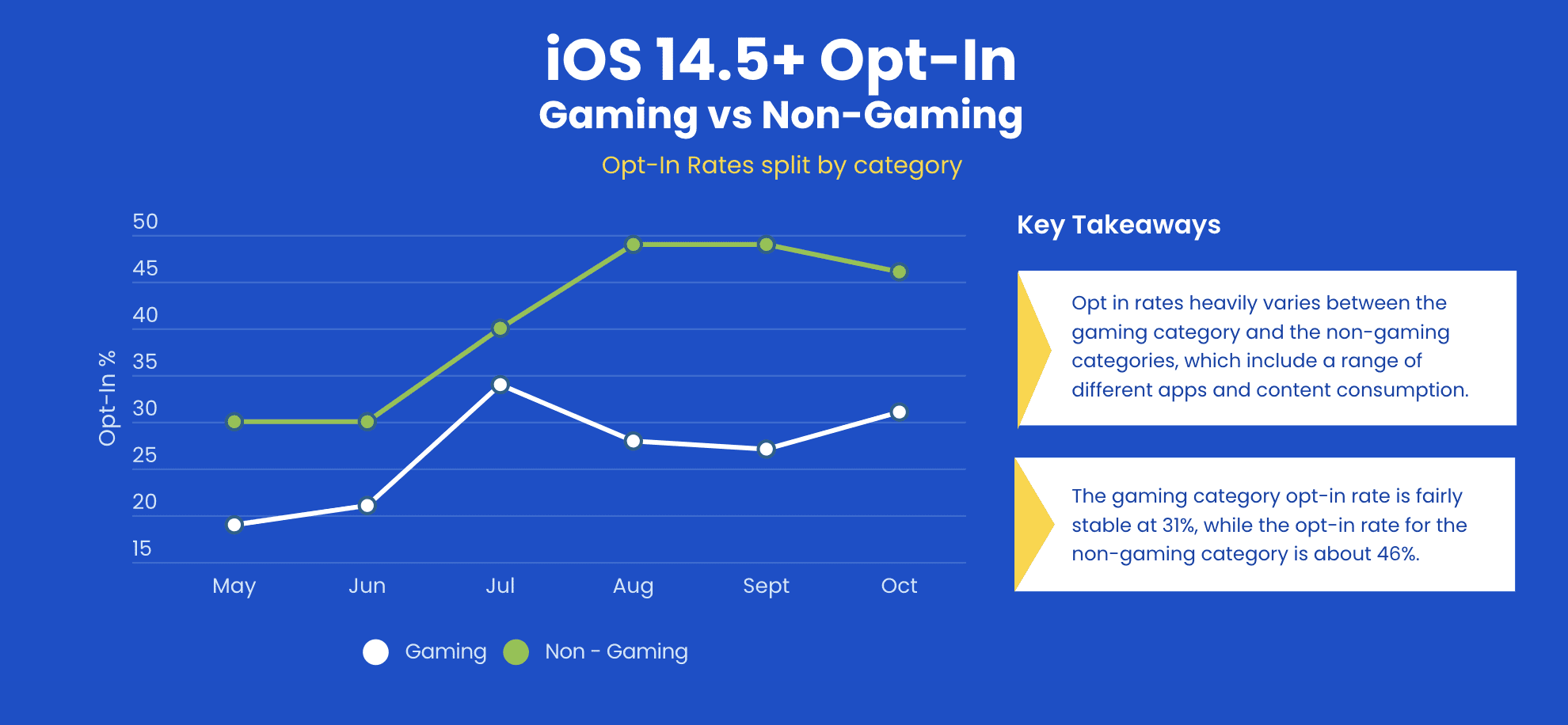

Another interesting trend to note is how user opt-in rates vary across apps and app categories.

For example, comparing apps on InMobi, opt-in rates for non-gaming apps are almost 70% higher than those for gaming apps (46% vs. 31%). Similarly, opt-in rates vary between apps within the same category too.

ATT opt-in rates (overall, gaming vs. non-gaming)

This variation shows that consumer preferences for ad personalization are not as uniform as one might assume. The same user could opt in to tracking for some apps and opt out for others. Their preferences vary due to factors like how frequently they use said app, how long they have used (or will use) such apps, how publishers have sensitized them about how ad personalization supports their app and gaming content, etc.

The bottom line is this: users are more inclined towards sharing data when they get a better user experience in return. At a time when many brands and publishers are increasingly looking towards first-party data as the future of personalized advertising, this is an encouraging sign for them.

3) Mobile budgets aren’t going away, but advertisers are seeking more addressability

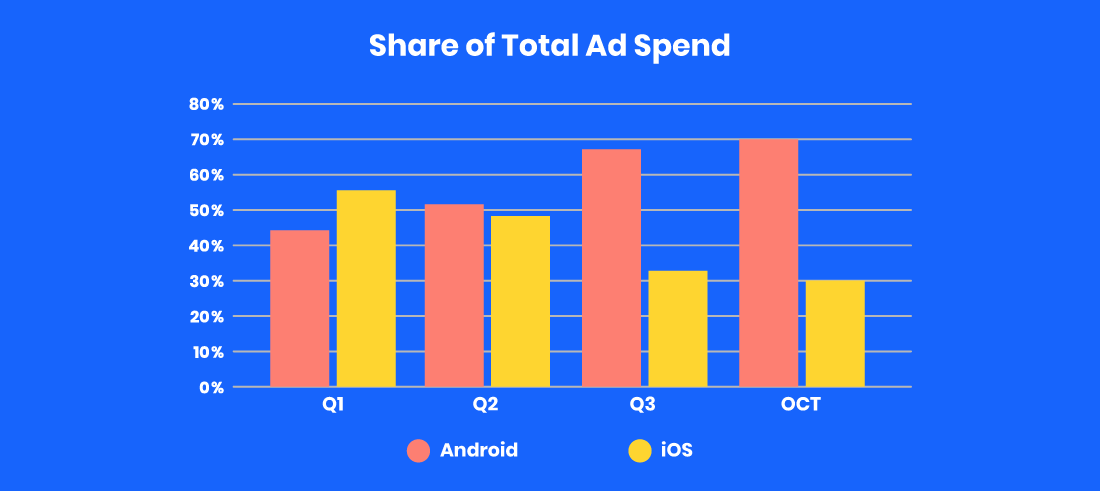

In the lead-up to the actual enforcement of ATT by Apple, there were many apprehensions of mobile budgets going away, but we have not seen much impact. Contrary to industry estimates (like this) which predicted a 5-15% impact on ad revenue, overall ad spends on InMobi Exchange did not see much impact. The quarter-on-quarter ad spend trend in 2021 showed seasonality similar to previous years.

We observed three key trends on the buy-side that explain this unexpected lack of impact on ad spend.

1) Advertisers moved budgets to Android

While advertisers on InMobi Exchange spent 44% of their Q1 budgets on Android, this number increased to 51% in Q2 and 68% in Q3. While overall mobile ad budgets remain relatively stable over time, advertisers are clearly investing more into addressable channels (I.e. Android) at the expense of non-addressable ones.

2) User Acquisition (UA) campaigns continued to spend on iOS

With brand budgets moving to Android, iOS inventory became cheaper. UA advertisers leveraged this to drive even more iOS installs. Relying on InMobi’s SKAdNetwork (SKAN) compliant supply for attribution, performance advertisers on InMobi Exchange served even more iOS impressions in Q3 than in Q2 – a quarter-on-quarter increase of 35%.

3) ATT normalized buying inventory without device IDs

Many advertisers who had earlier refrained from buying LAT inventory reconsidered their approach. UA advertisers leveraged SKAN for attribution to start buying LAT supply. Also, advertisers running top-of-the-funnel campaigns leveraged private marketplace deals (PMPs) to optimize towards upper funnel KPIs like reach, views, video completion rates (VCR) and viewability.

How InMobi Helped Advertisers and Publishers Adapt to the Post-IDFA World

While the above numbers reflect how users and the ecosystem have adapted to the ATT changes, we at InMobi have worked hard to help our publishers, demand partners and advertisers stay on top of these changes. They were vital in ensuring InMobi saw a negligible impact on ad spend during this time, even as the ecosystem was navigating a massive paradigm shift.

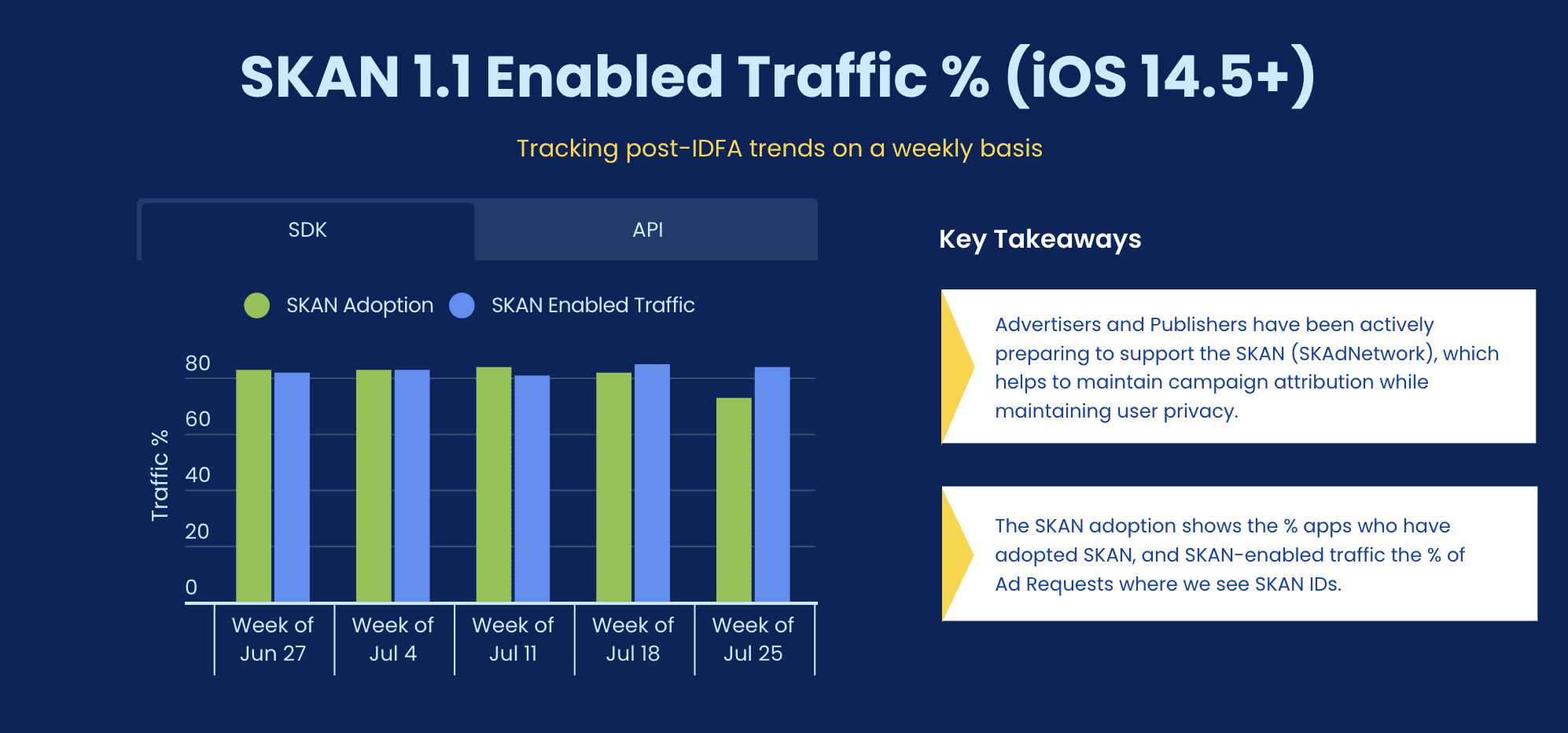

1) Accelerated SKAN adoption: We were one of the first SSPs to roll out our SKAN-ready SDK and worked with our publishers to upgrade them to be SKAN-compliant. By June, 80% of InMobi supply was already compliant with SKAN v1.1. And we are following the same playbook for SKAN v2.2, Apple’s latest SKAN release, which introduced support for view-through attribution.

2) Customer-first education: We also initiated a series of one-on-one and broader customer and partner awareness programs to help them navigate these changes with minimal impact to their business goals. These included blog pieces and newsletters, bite-sized video courses on InMobi University, and multiple in-depth guides and playbooks for our partners and customers on both the buy and sell sides. (You can find all of these resources on our IDFA Resource Center). These guides helped publisher partners with best practices on everything from implementing ATT prompts to maximize user opt-ins and tactics to improve yield in the post-IDFA world. For the buy side, these guides helped media buyers understand how and when to choose between various options like moving budgets to Android (in the short term), contextual targeting and KPI-based PMPs depending on their objectives, audience criteria and target KPIs.

In the spirit of full transparency, we also published an IDFA insights tracker that highlights key ATT statistics from InMobi Exchange like opt-in rates and SKAN adoption since May 2021. This tracker, updated every week for the first few months, helped our customers, partners and the broader ecosystem get an insight into how the post-ATT landscape was evolving.

3) Improving yield for publisher partners: Apart from helping publishers with best practices and guides, we also worked with them to optimize their waterfalls and pricing, increased their access to premium demand by moving them to header bidding setups, and released newer high-performance ad formats that improved their yield on both LAT and non-LAT traffic.

4) Alternative targeting options: For the buy side, we eased the operational effort for media buyers through PMP targeting options that helped them find relevant users and inventory more efficiently. We made it simpler to target or exclude LAT traffic, easier to target contextually-relevant apps using standard IAB categories, and set up KPI-based PMPs for buyers optimizing towards upper-funnel media KPIs like viewability, video completion rates (VCR) and click-through rates (CTR).

5) Addressability and targeting solutions: Universal IDs will be crucial in enabling 1:1 personalized advertising in the post-IDFA and post-cookie world. We have been working on several universal ID-based solutions for both the buy and sell sides.

In April 2021, we launched UnifID, a first-of-its-kind solution for in-app publishers to integrate with multiple universal IDs through a simple interface. With UnifID, publishers can integrate with leading universal ID solutions like LiveRamp, Britepool, ID5, Liveintent and Epsilon and increase the addressability of their inventory with minimal integration work and at zero cost. We have also released AmplifID, a buy-side solution (currently in beta) that helps buyers run in-app universal ID targeting via PMPs. We are also working on launching an on-device targeting solution.

Stay Up to Date

Register to our blog updates newsletter to receive the latest content in your inbox.