- Solutions

- Resources

- About

- Trust and Brand Safety

The Hidden Cost of Install Ad Fraud on Your Business

If you think the cost of mobile ad fraud is simply down to the fraudulent installs detected by your anti-fraud tool, then you are mistaken.

Computing the dollar impact of ad fraud on your campaigns isn’t as direct. In reality, the hidden costs can potentially be multiple times higher.

It’s important to get an accurate picture of the actual cost of mobile ad fraud, as it can indicate the true effectiveness of various marketing channels. It can also help you evaluate the performance of the fraud tools (internal or external) that you have deployed and even prevent you from losing out to the competition.

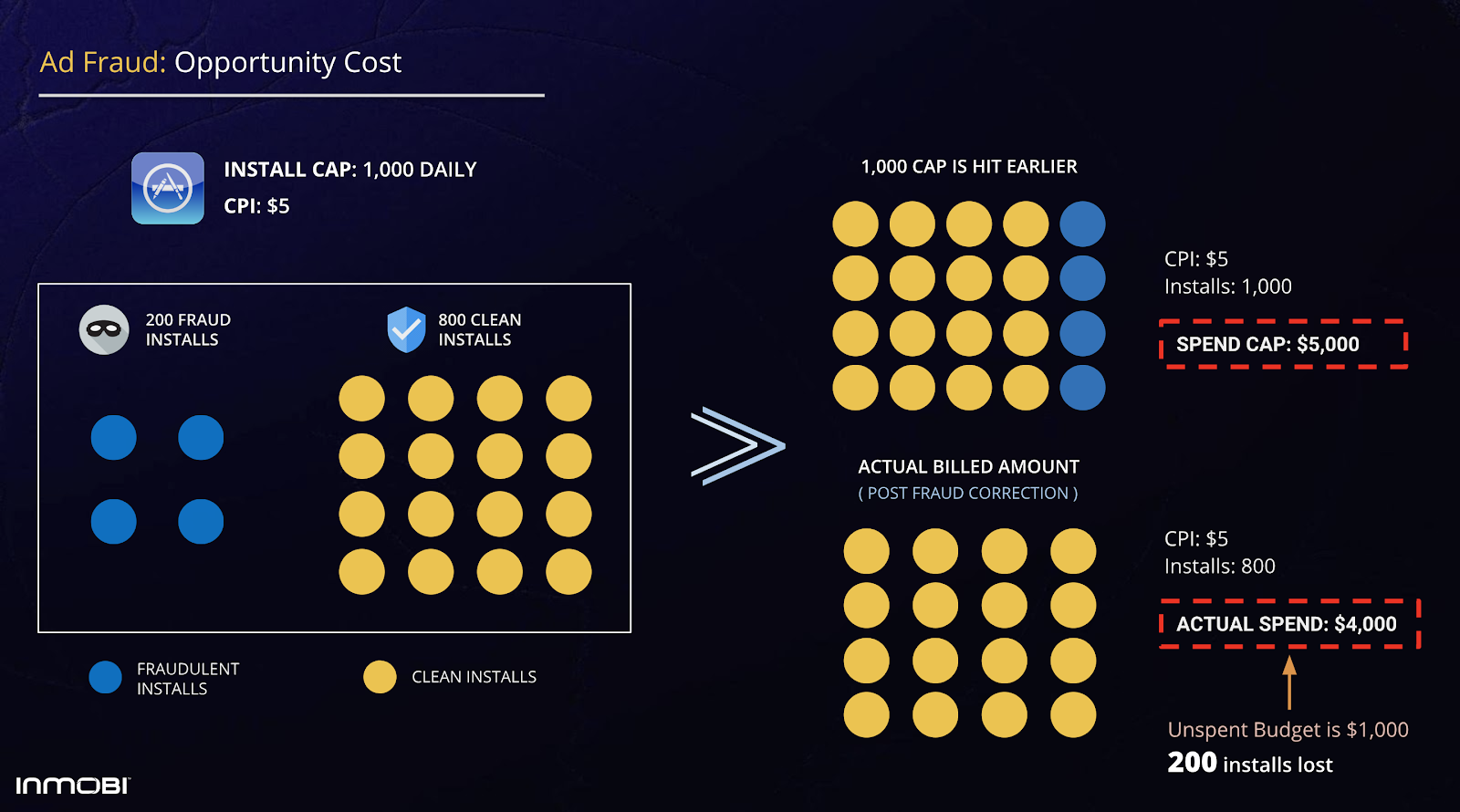

Opportunity Cost

1. Ad Fraud Exhausts Your Budgets Early

Fraudulent clicks and installs cause your daily budget caps to be hit earlier than they would otherwise since reversals are usually done post-facto. This means fewer conversions (installs, page visits, sales, etc.) on a daily basis.

So, while you get your money back on reported fraud, you don’t utilize the allocated spend. This lowers the expected performance.With fewer real people seeing your ads, you lose out on potential users and sales. This is illustrated in the following scenario:

Daily budget cap: $5,000

Cost per Install (CPI): $5

Total installs driven: 1,000

Fraudulent installs: 200

Billed amount: 800 x $5 = $4,000

Unspent Daily Budget: $1,000 or 20 percent

2. Fraudulent Installs Give Your Competitors an Advantage

Ad fraud means you are being taken out of the game early, every single day. In the above scenario, 20 percent of the daily budget is unspent, meaning two hundred fewer users for that day.

Every install or sale you missed out on due to unspent budget is one more potential install or sale for your competitor. Assume every five installs results in a purchase. That’s 40 additional sales being taken away from you and made available to your competitors.

While one might think that simply boosting the daily budget cap by 20 percent should fix the problem, it isn’t as easy. Fraud is not always constant. So, what is 20 percent today could as well we be 40 percent tomorrow.

In essence, fraudulent installs is a theft of the future even if you don’t pay for the cost of the fraud committed. This directly impacts your competitiveness, especially in winner-take-all industries.

Sunk Fraud Costs

3. Misallocation due to Skewed Metrics (Reducible Cost)

If you are manually optimizing campaigns, then decisions based on real-time metrics will likely be heavily biased by fraud.

For instance, ad click-through rates (CTR) will be higher on campaigns with high click fraud rates, while Cost Per Sale reported will be higher than it is in reality. Also, some segments may appear to be performing better due to fraud (misattribution or stealing organics) leading to allocating higher ad dollars to those campaigns.

This means you end up allocating more budget towards fraudulent channels and less budget to clean channels.

However, this cost can be minimized to a large extent by deploying more accurate fraud detection and prevention mechanisms.

4. Irreducible Sunk Fraud Cost

It’s not possible to detect, much less prevent, all fraud. Thus, despite the best efforts, there will always be a certain percentage of conversions that escape the most advanced fraud detection frameworks. There is no way to recover this amount.

There is also the cost of recovery. In extreme cases, such as the MethBot operation, advertisers learn much later about the extent and the impact of fraud. It might not always be possible to recover the costs.

Cost of Anti-Fraud Tool

5. Payment to Anti-Fraud Tool

As more and more money flows into digital and specifically mobile, ad fraud will grow. The cost of anti-fraud tools are significant as billing structures are either click-based or conversion-based.

Note: The pricing model is probably the best indirect indicator of effectiveness (and intentions) of the anti-fraud product and the company. Billing on the basis of number of installs flagged as fraudulent is incentivized towards marking fraud and not necessarily detecting fraud. It’s easy to see why — the more installs marked as fraud, the higher the payout.

Intangible Costs

6. Optimization and Productivity Losses

Instead of spending time strategizing and optimizing campaigns, digital marketers are busy tackling fraud and dealing with arbitration, causing optimization losses. Also, such efficiency loss and increased overheads are long-term effects.

Computing the True Cost of Install Ad Fraud

Cost of Fraud = (Fraudulent Installs * CPI) + Opportunity Cost + Sunk Fraud Cost + Anti-Fraud Tool Cost + Intangible Costs

As seen above, while the true cost of ad fraud might not be completely quantifiable, you can be sure that it is much higher than what’s shown on the dashboard of anti-fraud tools.

Thus, advertisers who aren't assessing the impact of ad fraud accurately on their campaigns are already at an increasing competitive disadvantage. This is because they significantly underestimate the costs, risks and exposure to ad fraud, and so they end up not being able to tackle fraud as effectively.

Ad fraud continues to be a growth industry, but the situation is not irreparable. Using better and more advanced anti-fraud frameworks, plus employing best practices, can help assess the risks and curb the ad fraud menace.

Next Steps

You need to ensure your mobile advertising increases your ROI. With fraudulent activities rendering a portion of your team’s efforts worthless, it’s important to invest in good anti-fraud tools to safeguard your ad dollars.

The most direct way to interpret the effectiveness of anti-fraud tools would be to see if it:

- Increases conversion rates

- Decreases invalid clicks and installs

This is possible only if the anti-fraud tool has fraud prevention capabilities and not just fraud detection. Being reactive (detection mode) means losing out on users and revenue directly to the competition.

So, how does one evaluate the countless anti-fraud solutions available in the market? Check out our blog on A Buyer’s Guide to Anti-Fraud Tools for more on how to choose an anti-fraud tool that effectively handles install fraud prevention.

Image: Opportunity Cost illustrated

Stay Up to Date

Register to our blog updates newsletter to receive the latest content in your inbox.