- Solutions

- Resources

- About

- Media Consumption & Trends

Understanding the On-Demand Video Streaming App Landscape Today

There are dozens of on-demand video streaming apps available today in the U.S., from big players like Netflix and Amazon Prime Video to smaller and newer entrants to the market like Quibi, Vudu and Apple TV+. But who specifically are using these video streaming services, and what devices are being leveraged by Americans to watch movies and TV shows?

We specifically wanted to look at video streaming platform use from March through June of 2020, when many Americans were sheltering in place or otherwise impacted by COVID-19. During this period in particular, how has demand for both paid and ad-supported video on demand services been impacted?

Streaming on-demand video content has long been popular in the U.S. Based on our data on observed consumer behavior, we expect to see an increase in consumer engagement and usage, but how much and with whom?

For this review, we turned to the data. Not only did we look at trends from our first-party telco data sources, we have also been conducting mobile-first surveys through InMobi Pulse.

Here’s what we found.

Mobile App Install Trends Since March

By the end of the March, overall use of the top streaming platforms was up 12%. Our own data bears this up, with mobile app installs in the space increasing throughout much of the second quarter of 2020.

Throughout most of the period, Netflix was the most installed video streaming app across both Android and iOS mobile devices. This is hardly surprising, as Netflix has long had first mover advantage in the space.

What has been surprising is that at different points in this period in question, installs of the Pluto TV mobile app were greater than or on par with Netflix app installs, in particular during late March and mid April. Pluto TV is a free, ad-supported video player that’s owned by Viacom, and its strong growth throughout this period shows that there is space for non-paid streaming movie and TV apps today amidst a relative glut of paid options, so long as it has high quality content. According to Forbes, “the number of active monthly Pluto TV users jumped 55% from a year earlier” in March.

Hulu has seen its ups and downs during this period, as has Amazon Prime Video. There have been moments where Hulu was the second most downloaded app in the space, while at other moments it has been leapfrogged by Tubi TV, among others. Amazon Prime Video has started behind many of its competitors back in March, but has seen significant growth starting from the end of March.

What about newer entrants to this space like Disney+ and Quibi? Disney+ had a spike of installs in March, while Quibi saw notable gains in April through a free trial offer and then again in May. However, Quibi largely lags behind others who are not as focused on mobile as they are.

Who are Downloading Video Streaming Mobile Apps Today?

We also wanted to look at the kinds of individuals who have been downloading and using these apps. Are the people who are downloading these apps since March different at all from those downloading these apps earlier in the year?

What we found was that female app users continually increased during and after the shelter-in-place mandates vs. pre-COVID-19 installers. Further, users between the ages of 26-55 increased during the shelter-in-place mandate but begun to plateau recently.

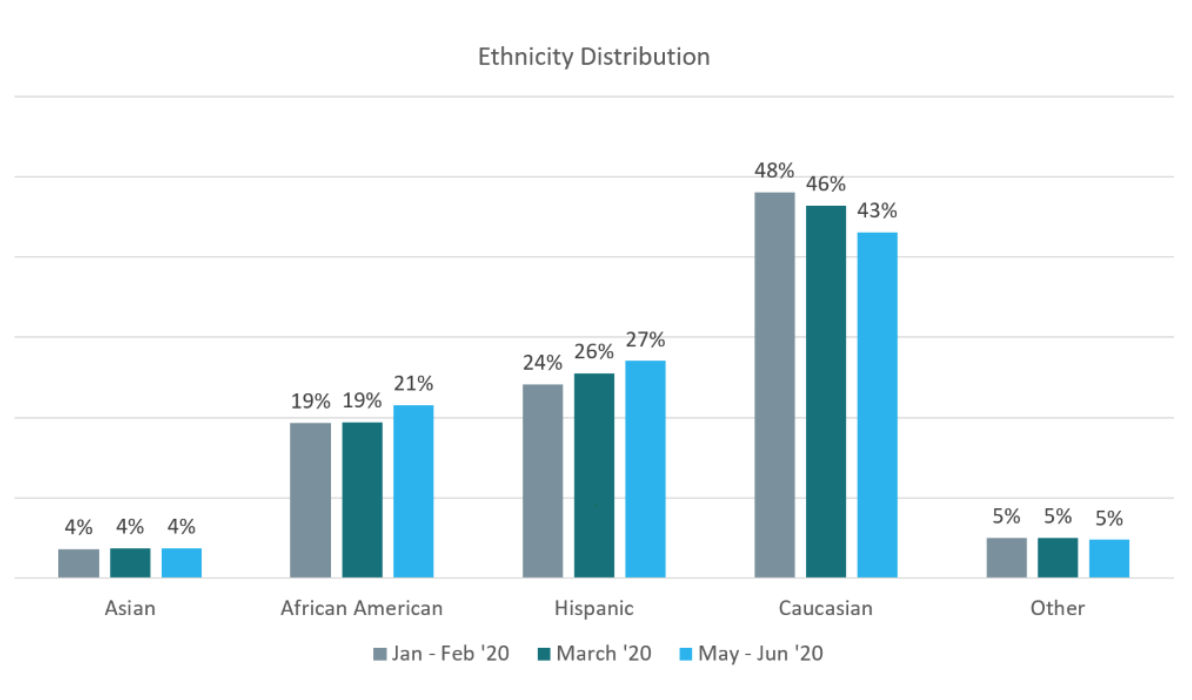

Shelter-in-place and recent app installers are more ethnically diverse than the typical entertainment app installers. All non-White ethnicities saw varying increases with the only decrease among White users.

In addition, users with income levels $35,000 and above all increased during the first month of shelter-in-place, with the largest increases in the $35,000-$125,000 income ranges. These income ranges’ usage continues to rise as the year goes on.

Highlighting Consumer Sentiment

Do Americans claim to be consuming more streaming content recently? To find out, InMobi has been polling adults in the U.S. for every month since March to see how their habits are reportedly changing over time.

For starters, the share of survey respondents who said they are streaming more TV recently went from 25% in March to 35% in May. This is not surprising, and aligns with what our mobile app install data shows.

It is also important to note that audio streams are increasing of late too, with music streaming being a popular pastime during shelter in place as well. The share of Americans who said they are listening more to music or the radio has gone from 17% in March to 26% in May.

Streaming Service Adoption Motivations

We also wanted to see how many streaming services the typical American is willing to pay for and use. Since there are so many streaming services people are willing to pay for or have time to enjoy, how many options would they be open to paying for and using at any one time?

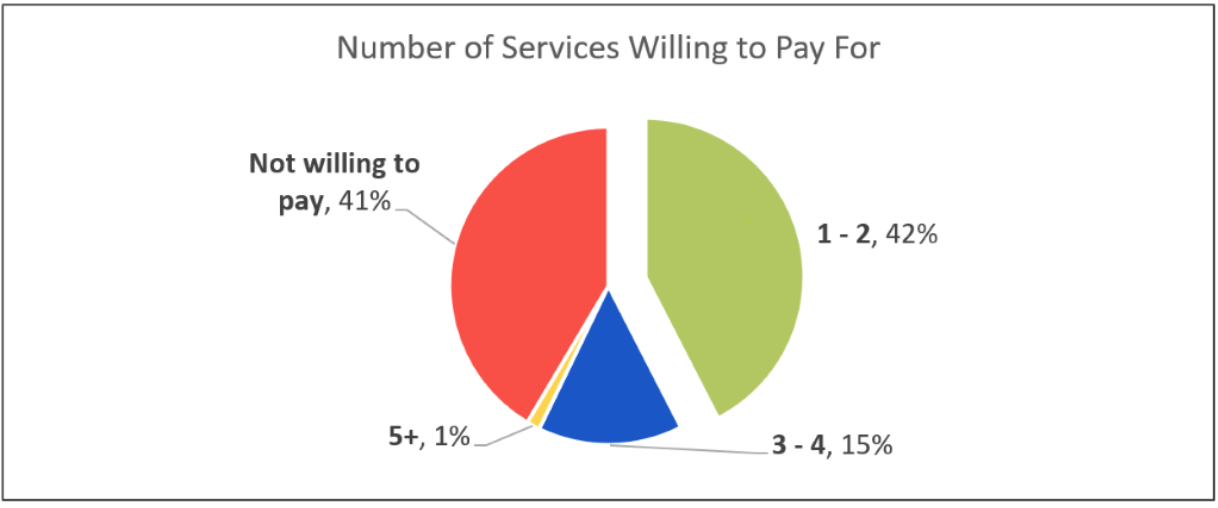

According to separate mobile surveys, 42% said that they would largely willing to pay for one to two streaming services at one time. Of consumers age 56-65, 31% are not willing to pay for a streaming service, while 28% of households with kids will pay for three to four services.

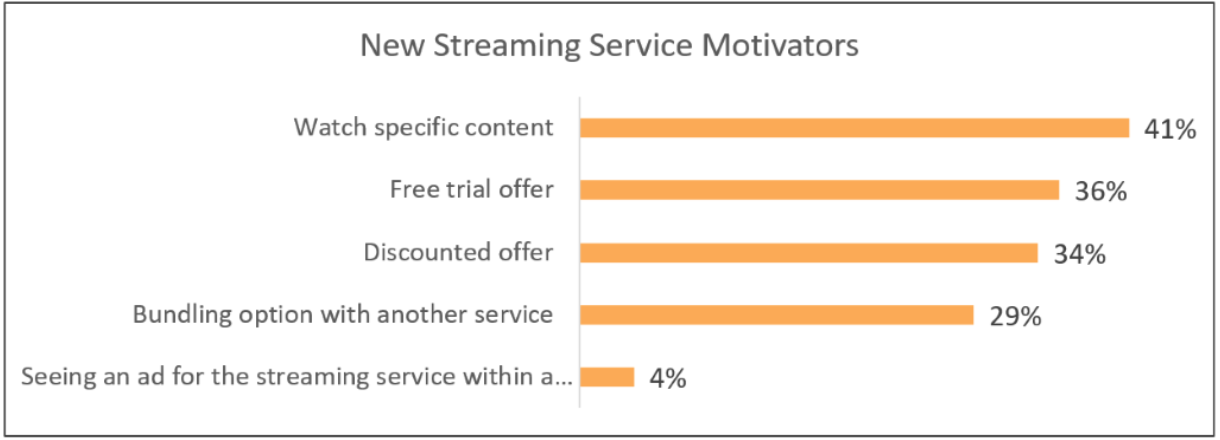

We also wanted to look at how people can be convinced to adopt or use a new video streaming platform. Most types of offers will encourage consumers to try a service, but specific content (41%) followed by a free trial (36%) or discount offer (34%) are the strongest drivers. It is worthwhile to note, however, that discounts are an even stronger driver for those 18-25 (52%) and those who are 56-65 (44%).

It seems likely that video streaming platforms will continue to be well used in the future as well. According to Americans surveyed in June, 60% said they would be uncomfortable attending an entertainment venue even if they were open in the next month.

Reaching Video Streaming Fans Through Mobile Apps

How can brands reach these content streamers, especially since some of the top video on demand apps don’t run ads? And, where can video streaming services find their audiences on mobile? Apply InMobi custom audiences to reach the shelter-in-place entertainment users. Here’s a small sample of what’s available:

- Users of leading video game consoles (people who own a physical gaming console)

- Movie theater visitors (people who have gone to a movie theater in the past six months)

- Entertainment enthusiasts (users who have visited any entertainment site or have downloaded any entertainment app in the past six months)

- Cord cutters (based on app/web behavior and is inclusive of users who were seen with any TV/Video Streaming service downloaded on their device, or who have visited a TV/Video service site in the past six months)

- Amusement park visitors (Based on user's who visited an amusement/theme park in the past six months)

- Sports enthusiasts (This audience is based on app/web behavior and is inclusive of users who were found to have downloaded or visited a sports property in the past six months, inclusive of all major sports networks and publications)

Interested in learning more? Reach out today to speak with one of our experts.

Stay Up to Date

Register to our blog updates newsletter to receive the latest content in your inbox.