- Solutions

- Resources

- About

- Advertising

- Consumer Research

- Understanding Consumers

The Latest U.S. Holiday Shopping Insights

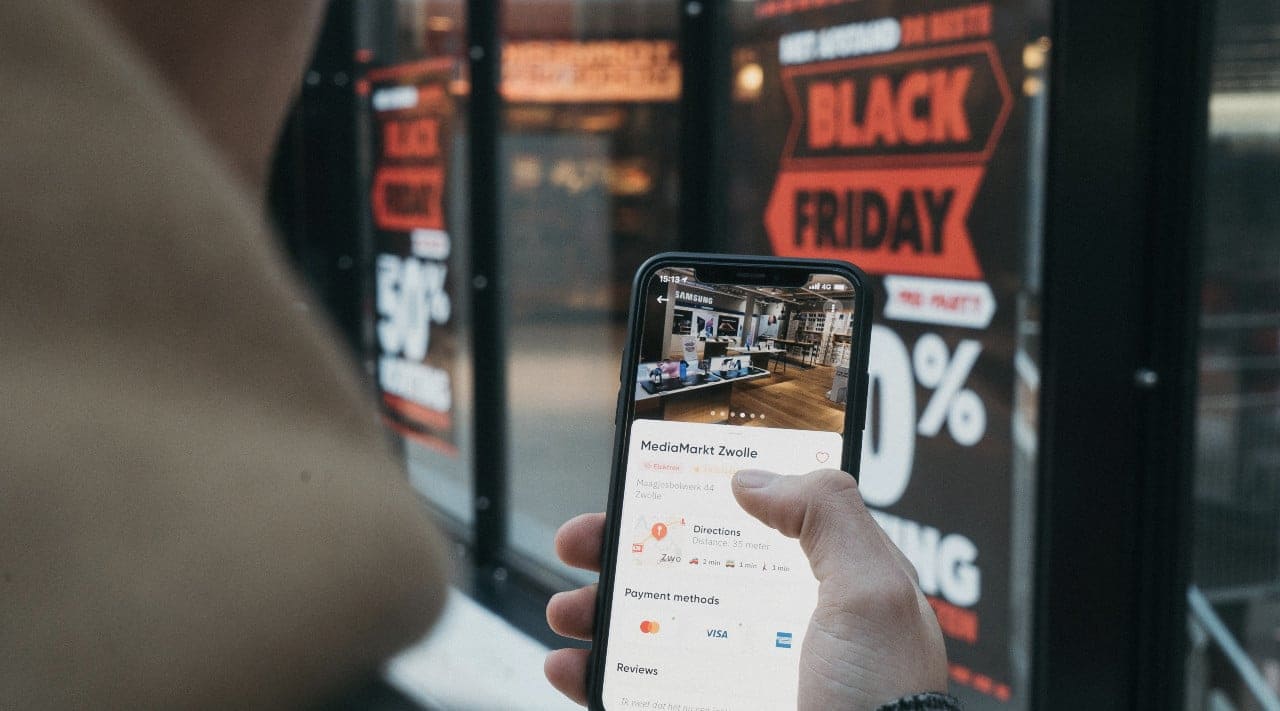

With Christmas, Kwanzaa and New Year’s fast approaching and with Hanukkah already over, how are Americans currently thinking about and approaching their holiday shopping at this point in the year?

To find out, we turned to InMobi Pulse, InMobi’s mobile market research solution. Between November 30 and December 13, we surveyed over 750 adults in the U.S. of different genders and ages to see how the holiday shopping season was going for them. Specifically, we wanted to gain insights on holiday shopping behavior in the period after the Cyber Five (Black Friday to Cyber Monday) but before Christmas.

Here’s what we uncovered.

TL;DR Version

Here are the top five things you need to know about the remainder of the 2021 holiday season.

- 30% haven’t started holiday shopping yet.

- 26% are not enrolled in any major retail brand loyalty program.

- 41% are likely or highly likely to purchase a gift card as a present for the holidays this year.

- 47% will purchase holiday meals or groceries for holidays meals this year in person.

- 24% are not purchasing gifts this year.

Is It Too Late to Reach Holiday Shoppers?

Despite all of the messaging in market about supply chain and labor issues, procrastination abounds. Overall, 30% said they haven’t started their holiday shopping yet at all, while an additional 16% said they have only completed a little of their holiday shopping so far.

Who are the biggest procrastinators? According to our research, it’s men (35% of whom haven’t started their holiday shopping) and people between 45 and 54 years old (38% of whom haven’t started their holiday shopping).

What will the procrastinators be shopping for? For the most part, they’ll be buying apparel (22%), home goods (21%), toys (20%) and home electronics (20%).

Unpacking The Role Of Retail Loyalty Programs

In an era of increasing brand disloyalty, brands and retailers are fighting back. Specifically, many leaders in this space have been aggressively rolling out loyalty and rewards programs to keep consumers coming back. Amazon Prime is perhaps the most well-known such program, but it’s far from the only one.

But are consumers taking advantage of these programs? Over one in four said they are not enrolled in any major retail loyalty program.

It is a different story with younger consumers, however, as our data shows they are much more likely than older Americans to take advantage of customer loyalty programs. Just 15% of those between 18 and 24 years old and only 16% of those between the ages of 25 and 34 said they aren’t enrolled in any major retail loyalty program.

The most popular option that consumers are using is, perhaps unsurprisingly, Amazon Prime. According to our research, 22% are current Amazon Prime members. Other popular options include Walmart+ (19%) and Target’s Circle Rewards program (13%).

For major retailers, it’s probably worthwhile to get more loyalty program signups. That’s because 48% of all shoppers said they were likely or highly likely to use a retail's loyalty program when purchasing holiday gifts.

How To Obtain More Loyalty Program Signups

So what can retailers do to get more loyalty program registrations? Price is a good place to start. According to our research, 31% are looking for discounts and promotions when signing up for a brand's loyalty program – that figure jumps to 44% for women and to 51% for people over 54.

Other common reasons to sign up for a retail rewards/loyalty program center around product choice and convenience. Overall, 27% said they are looking for product selection when signing up for a brand's loyalty program, while 22% are looking for curbside pickup.

The Role Of Gift Cards In The 2021 Holiday Shopping Season

The stalwart present option for everyone on your holiday shopping list is a gift card. Don’t know what someone likes? Not sure what to get for your cousins or co-workers? Gift cards are always a good choice.

Overall, 41% said they were likely or highly likely to purchase a gift card as a present for the holidays this year. It’s a slightly different story with younger Americans, however, as 36% of those between the ages of 18 and 34 said they are unlikely or highly unlikely to give someone a gift card as a present this year.

Among the gift card-giving crowd, which options are most popular? Top options were gift cards to Walmart (26%), Amazon (25%) and Target (18%).

Why these brands? More often that not, survey respondents said it’s because they are the gift card recipient’s favorite retailer to shop from.

How Are Gift Cards Spent?

Among those who get gift cards as holiday presents, 57% redeem them in person. The share is even higher for women (65%) and Americans over the age of 54 (79%).

Younger Americans, however, are more likely to redeem gift cards through a mobile app than through a website or even at a brick-and-mortar store. For instance, 42% of those between 18 and 24 said they spend gift cards in app, while 35% redeem them in person.

Food For The Holidays

The holiday season is about more than gifts – it’s also about stuffing our faces (at least for many of us!). So what will Americans do to get their favorite holiday meals and treats ready?

According to our research, 47% said they will purchase holiday meals or groceries for holidays meals this year in person. There is a generation divide, as older Americans heavily prefer in-person options while younger Americans are more comfortable using digital options like apps and websites.

For holiday groceries, where will Americans turn? Overall, the top choices were Costco or Sam’s Club (17%), Kroger (17%) and Publix (11%).

Other Key Insights You Should Know

Close to one in four consumers say they aren’t making any holiday purchases this year. For brands and retailers looking to make a big impact, this is a worrisome figure. This likely means that there are still lingering economic issues, with many consumers electing to save as opposed to spend.

Among those that are shopping for the holidays, what items have they bought already? According to our research, it’s mostly been apparel (27%), toys (26%) and home goods (24%).

How To Capture Last-Minute Holiday Shopping Dollars

With 2021 quickly coming to an end, what can brands and retailers do to end the year on a high note? Based on our data, here’s what we recommend:

Continue running promotions and advertising campaigns. A significant number of holiday shoppers are waiting until the last minute, which means there’s still time to make an impact.

- Promote your customer loyalty programs, especially if signing up confers monetary benefits like discounts. New registrations will boost the bottom line in 2021 and beyond.

- Gift cards remain a viable and popular gift choice for the holidays. With supply chain issues continuing to plague brands and retailers, it may be more prudent to promote gift card options over specific items that may go out of stock sooner than anticipated. Plus, gift cards are unaffected by shipping delays, especially when gifted digitally.

- The busiest time of the holiday season for supermarkets? New Year’s Eve and the week before Christmas are near the top of the list. If they haven’t already, grocery stores and grocery delivery companies need to prepare accordingly by ensuring supplies and staff are ample during this key time of the year.

Interested in learning more about InMobi and how we work with brands and retailers during this key time of the year? Reach out today to speak with one of InMobi’s experts.

Stay Up to Date

Register to our blog updates newsletter to receive the latest content in your inbox.