- Solutions

- Resources

- About

- Consumer Research

- Media Consumption & Trends

- Understanding Consumers

What Do U.S. Consumers Want From Their Mobile Telco Phone Service Providers?

For a closer look at what consumers in the United States want from their mobile telco phone service providers, we recently polled over 600 Americans in July using InMobi Pulse, InMobi’s mobile market research solution.

Specifically, we wanted to measure general and informed awareness of new telco offerings and internet services like 5G, telco-specific credit cards, etc. In addition, we wanted to see what causes consumers to stay with or switch their mobile telecommunications service provider.

Note: we specifically excluded business phone services like SD-WAN from our analysis, only focusing on consumer offerings.

So a quality mobile telco service includes what exactly? Here’s what we uncovered.

Top Takeaways

- The majority of consumers know that mobile telco providers offer Wi-Fi hot spots and 5G connectivity, but few know about all of 5G’s benefits.

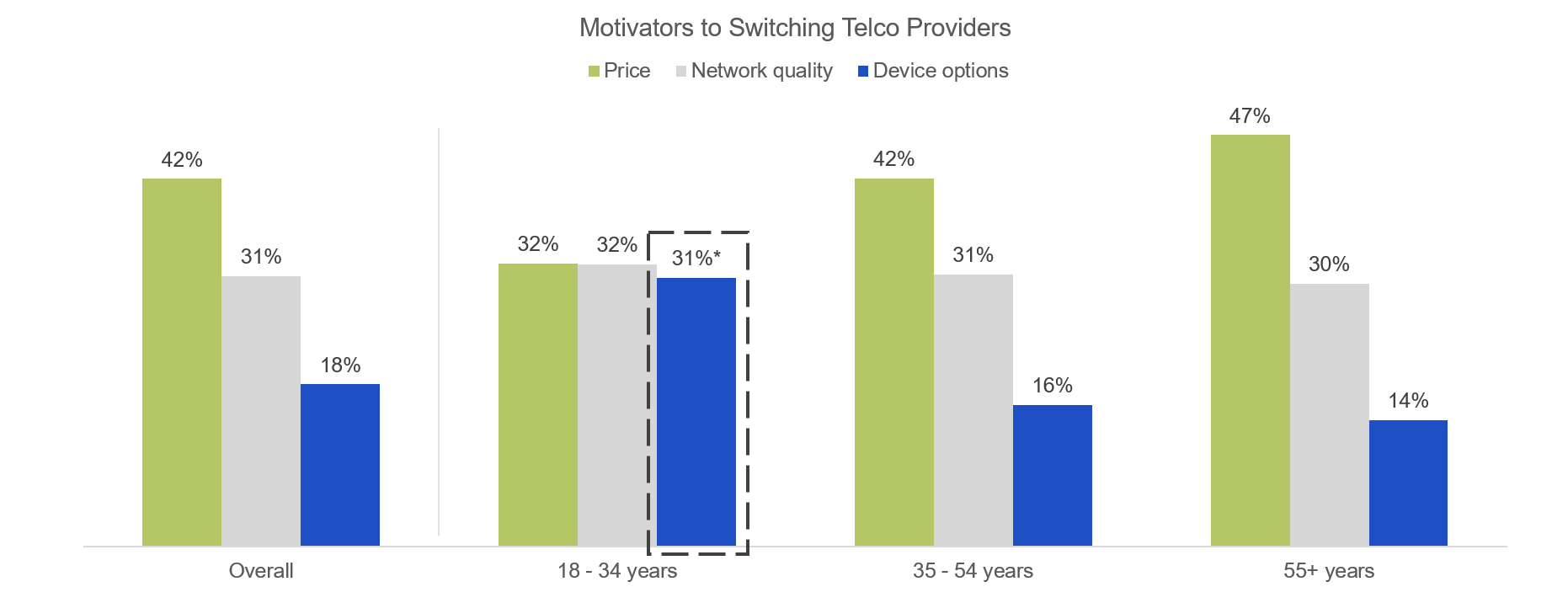

- Price and network quality are the biggest motivators for switching telco providers.

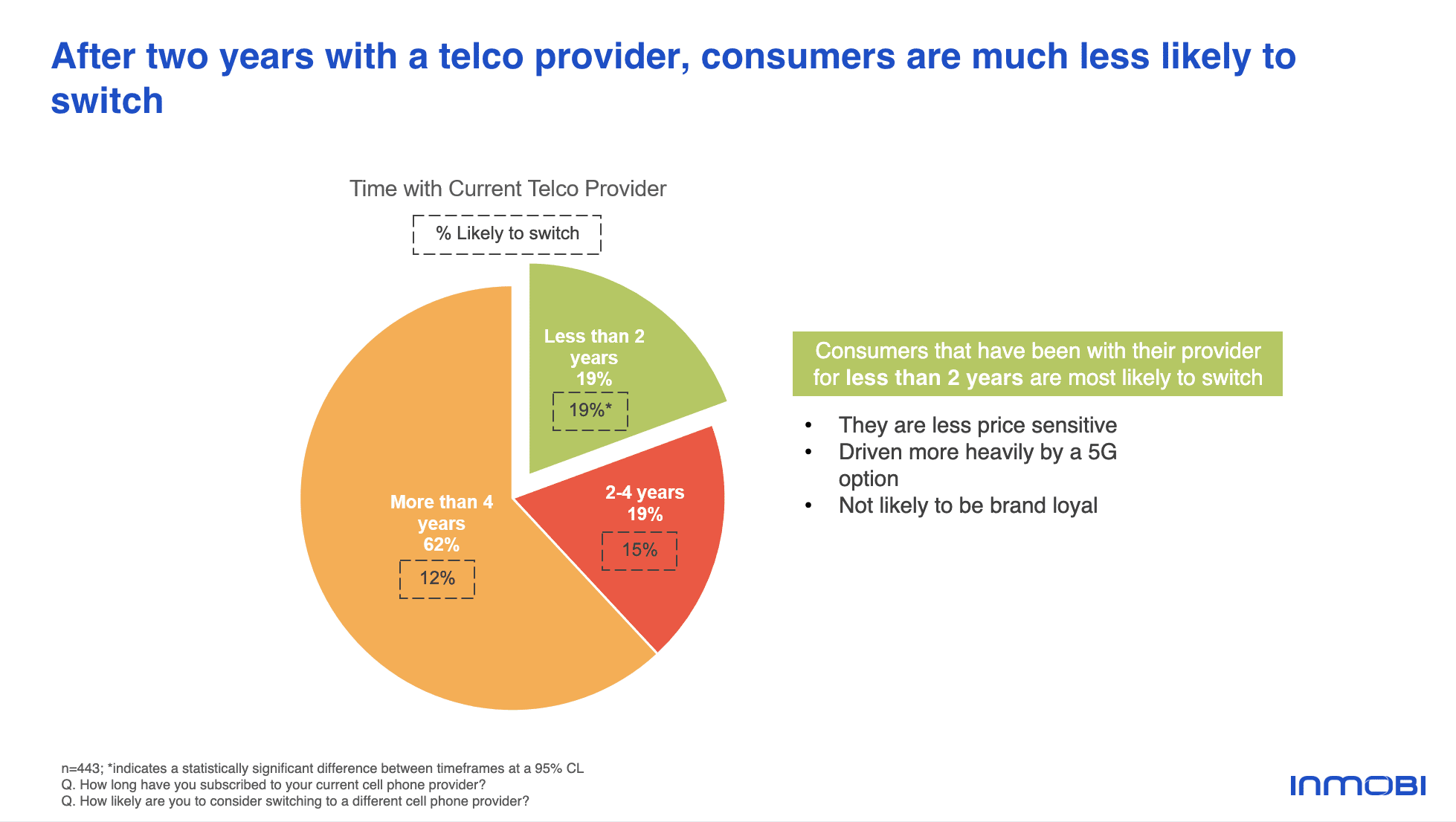

- The longer someone has been with their current mobile telco providers, the less likely they are to switch to a new one.

Will a 5G Network Entice Customers?

Many cell service providers are quickly rolling out new features like 5G connectivity, improved cellular internet connections, new mobile payments options and more as part of a wider effort to expand their business and make it stickier. But do consumers care about these features? And do they even know about them?

On an awareness front, 63% said they knew cellphone providers offer Wi-Fi hot spots while 59% said they knew about 5G; women were more likely than men to say they knew about these features. In comparison, 57% knew cellphone providers provided access to streaming services while just 27% knew about mobile telco credit cards.

Let’s dive in on 5G in particular, since it’s an especially hot topic in this space. Among those that knew about 5G, 76% of them were aware that it provides faster download speeds; for Americans between 18 and 34, the percentage is even higher. Further, 69% of this cohort said they knew 5G provides faster sending and receiving times. But, only 40% said they knew 5G allows for more connected devices.

This is potentially a missed opportunity. If more consumers knew about 5G and its many benefits, then telcos could use 5G as more of a hook to gain new customers and keep existing ones happy. Let’s dive into this more.

Why Mobile Telcos Need More Than Good Customer Service

When we asked consumers in the U.S. about what would encourage them to switch to a new cellphone provider, just 12% cited 5G. The most commonly cited motivators for switching telcos were price (42%) followed by network and service quality (31%). Of course, it’s important to note that both of these are impacted by 5G, as an upgraded network provides better coverage and speeds but at the same prices.

Older consumers were the most price conscious. Among those over 55 years old, 47% said price was the top motivator for switching telco providers; 42% of those between 35 and 54 years old said the same thing.

Younger consumers show slightly different trends. Among consumers between 18 and 34 years old, 31% said device options were the top motivator for switching telco providers. In comparison, 32% of this cohort said network quality was a top motivating factor.

But among those for whom mobile device options are a key switching motivator, price still is a major determinant. Overall, 18% said mobile device options were a key factor to switching telcos. When we asked this group about what device options in particular were important to them, 63% said device price while 48% said a free device was a determining factor.

Overall, however, it’s important to note that most telco customers are quite loyal. Among those that have been with their current providers for less than two years, 19% said they were likely to switch. In comparison, just 12% of those who have been with their current provider for over four years said the same thing.

How Mobile Telco Service Providers Can Use This Data

Here’s how cellphone providers in the U.S. can leverage these insights to bring in new customers and retain their existing customer base:

- Focus on price and network quality, since these are the two biggest reasons someone will switch cellphone providers. Advertising and marketing messaging should really hone in on these two components.

- Highlight all of the benefits of 5G. While most consumers know about 5G, it’s not truly widespread yet. And, many people don’t know that 5G can provide cheaper and more comprehensive coverage for more devices. A targeted advertising and marketing campaign can help alleviate these knowledge gaps, however.

- Acquistion and retention efforts should focus on recent customers. While most telco customers are quite loyal, newer customers are much more likely to defect than most established customers. This knowledge should underpin both new customer acquisition and existing customer retention.

Interested in learning more? Reach out today to speak with one of our mobile experts.

Stay Up to Date

Register to our blog updates newsletter to receive the latest content in your inbox.